|

|

|

December 7th, 2024 at 04:38 pm

Oh, wow, I see everyone is posting their net worth. Since the market is doing so well, I may as well post mine, which has risen to $1.6 million (including the house). Nice. This figure does not include my monthly-for-life annuity payments or Social Security, which I won't claim for another 4 or 5 years.

Hope everyone is enjoying the holiday season. I must confess to a bit of a spending spree starting, I guess, in November. Here's what I've purchased so far that "feels" wierd just becus I've had a lifelong frugal mentality:

* Replaced my office chair, something I got 4 years worth of use out of after rescuing it from the dump! I also went outside my comfort zone and got the new chair in turquoise to match much of the art in my office.

* Replaced 2 kitchen chairs, which also had been acquired secondhand and were a little banged up. I brought them to the dump and a man grabbed them, which made me happy. The new ones are mid-century modern (love, love) and have a lower profile, which I think works better in my small kitchen.

* New wool blanket

On their way: An organic cotton guaze blanket for summer, a metal 3 in 1 bird feeder (compartments for 2 types of seed plus suet) to replace an old wood one that's missing one panel so seed tends to fall out) and a Kandinsky t-shirt for the gym.

I discovered a fun FB group devoted to people who feed and shelter wild opossums.  It led me to start leaving food out, though since they are nocturnal, you wouldn't be able to see them without leaving a light on and rechecking throughout the night, or having a wildlife camera, which is the next thing I want to buy myself. We'd had a light snowfall, so I could in fact confirm that an opposum stopped by. It led me to start leaving food out, though since they are nocturnal, you wouldn't be able to see them without leaving a light on and rechecking throughout the night, or having a wildlife camera, which is the next thing I want to buy myself. We'd had a light snowfall, so I could in fact confirm that an opposum stopped by.

Conveniently, I'd caught a mouse in one of my basement traps, so instead of tossing it in a certain spot in the pachysandra I knew I wouldn't be venturing into, I deposited said dead mouse near my other food offerings and the heated water. It gobbled up the sliced overripe banana and took off with the mouse but left the organic dates and whole wheat pasta.

Opossums are said to reduce local tick populations since they kill them when they groom themselves. They will also kill mice. Two good things, in my book, and also small snakes. While I like snakes, I don't like them in my basement, and they seem drawn to the warmth of my foundation in winter. (Ever notice how the snow melts surrounding your house before anything else?)

I have documented no fewer than FOUR snakeskins shed in my basement. I've done a lot of mouse-proofing under the lowest row of shingles, and that seems to have reduced mice getting in. I hope it does same with the snakes. I need to go around again since I caught that last mouse just yesterday after going mouse-free for a week or so.

I never got around to posting pix of the beautiful bobcats I saw here in my yard 3 or 4 weeks ago. Since they don't spend time together except to mate, I am guessing these 2 are mother and offspring. I watched them flush a rabbit out of the brush with ease and teamwork. Felt bad for the rabbit, but... This was a very rare and special sighting, and definitely a highlight of my 30 years here, as I have never seen 2 together, and I was able to take photographs for about 30 minutes before they disappeared.

Posted in

Uncategorized

|

10 Comments »

November 8th, 2024 at 01:38 pm

Since SA never bothered to inform us, in case you didn't know:

Type: Breach

Source: Mother of All Breaches (MOAB): savingadvice.com (62,583 Records)

On January 22, 2024, a large collection of previously breached data known as the 'Mother of All Breaches' (MOAB) was leaked online. Compromised data from savingadvice.com was included in the collection. ZeroFox extracted 62,583 records containing personally identifiable information from the data.

What should I do?

- We recommend you log into and change the password to any accounts where you use this email address to log in. Furthermore, be aware of any suspicious emails asking for your personal information as they may be phishing attempts designed to fool you into providing sensitive information to malicious websites.

Posted in

Uncategorized

|

3 Comments »

November 5th, 2024 at 02:35 pm

I have never felt the need to enroll in EZ Pass for NY-area bridges or toll roads because my travels into New Jersey, New York or points west are fairly infrequent.

However, I did make 2 trips to PA in the past 2 months, plus a trip to Jersey, so I knew to expect mailed bills for the Tappan Zee Bridge toll. I finally got the paper bill yesterday, and they were charging me a late fee for not paying an earlier bill that I never received.

I just decided to pay the whole thing (grand total $20.09) to avoid the hassles as I've had problems paying EZ Pass bills before, whether by phone, online or paper. In fact, I once received a rather ominous bill with hefty late payment penalties from a law firm doing collections for EZ Pass for a bill I had indeed paid! Thank goodness I saved the payment receipt, so I mailed them a copy and I never heard from them again.

On the paper bill, it said I could convert to EZ Pass NY and save $12.19 on the bill, yet when I called to pay the bill, the recording said I would save only .50. (I later realized I couldn't get the EZ Pass now because I plan to buy a new vehicle early next year, and EZ Pass would be registered to my current vehicle.)

The automated phone voice also said my balance was $2 higher than the paper bill. WTF? I just got the paper bill yesterday and it said I have until Nov. 27 to pay it. Multiple discrepancies.

And finally, when I tried to pay over the phone anyway, it rejected 2 different credit cards that I know to work fine.

When I called customer service, she said their system was down. Which might explain why my attempted payments were rejected.

I will call customer services again tomorrow to see if their system has been fixed. The person I spoke to today let slip that she couldn't erase the $5 late charge because their system was down, so I will ask them to do that tomorrow, and then pay the balance over the phone with the rep, but I'm super nervous about paying without getting a receipt due to all the mistakes they make. And then I will open an EZ Pass account after I get a new vehicle next year.

Posted in

Uncategorized

|

4 Comments »

November 2nd, 2024 at 07:26 pm

Yet another data breach compromising my personal info, except that this time I don't even recognize the name of the company that apparently had my info: Change Healthcare. Yet another data breach compromising my personal info, except that this time I don't even recognize the name of the company that apparently had my info: Change Healthcare.

I will call them Monday to find out who this is and what my relationship with them is. As is par for the course, all they can offer is free credit monitoring.

My new dentist came through with a $52 refund in the mail. I am now officially a senior, and they are the first dentist to offer a 10% discount to seniors, but I hadn't gotten it when I was there. I was also quoted lower prices for their services over the phone than what I was charged when I was there, becus they recently raised their prices. Good thing I keep notes. So that's what the refund is for; they volunteered to honor the prices I was given over the phone. The original bill (assuming a full set of x-rays and without the senior discount), was $280.

The reason I had left my last dentist is becus 1) they are a further drive, and the only reason I was going to them is becus they bought my regular dentist's practice when he retired, 2) but also because I didn't like their aggressiveness in pushing me for x-rays all the time.

My new dentist did the same thing, but we finally agreed on a set of 2 bitewings, or 4 x-rays all together. Instead of the full set of 21!! I am not a believer in getting annual routine x-rays when there is no discernble problem. X-rays have never revealed any problem in all the years I've seen a dentist, ie, all my life. At most, they look at them for about 30 seconds before consigning them to a file somewhere.

Radiation is cumulative, after all. She wants to do them every 2 years, more than I would like, so it's either fight those battles, which can be unpleasant, or try to find a dentist who doesn't push so hard. I mean, it is my body after all. I get really tired of the same argument from them and I suspect their insistence comes as much from a financial motive as a real concern for my dental well-being.

They did compliment me on my teeth (which others have done), and this totally surprises me since I have a lot of fillings from my childhood and I never wore braces. But I do take care of them. In fact, the dental hygienist, after looking at my teeth, said Oh, you know what you're doing...

I wasn't crazy about the hygeinist though. She just seemed a little heavy-handed. She was older and had plenty of experience, but I prefer someone who's more careful introducing tools to my mouth and so on.

I still remember years ago my mother telling me how extremely painful it was when she had to have scaling (cleaning below the gumline) was. After that, she was absolutely fastidious about her teeth becus she didn't want to repeat that experience. And neither do I.

In other news, I've already begun my holiday gift shopping and am well on my way. I pretty much know what I want to get for everyone except my cousin, the man who has everything. Having visiting him last month, I could see for myself the many, many boxes of unopened items he'd purchased online and never opened...terrible! How wasteful! Lately, at a loss for what to get him but feeling obligated becus he gets me very, very nice presents, i wind up shipping food to him from Omaha Steaks or similar companies.

I need to have my other cousin's gift all buttoned up by Thanksgiving since we've gotten into the habit of meeting for Thanksgiving at a restaurant in Westchester, and that's when we give each other our presents (not to be opened til later) to save on shipping.

My father complains each time I buy him something, saying I shouldn't have and otherwise undermining the joy I derive from giving something nice to a person I care about. That is why, ever since my mother passed, I like to buy little things for others. I would also like to make charitable gifting more of a regular thing, but I'm unsure how much I should put aside for this or what i can "afford." There are so many wonderful, deserving causes. There was a time I was donating $100 a month to a different group each month, and I enjoyed researching new-to-me groups as potential future recipients.

Two chickens have been hanging out in my yard the last few days. I posted their pictures on my town's facebook page and I was urged to call the animal control office asap so they could come catch them. Umm, don't think so. Then a woman way across town was hoping they were the chickens they lost and she came over, 3 little kids in tow, expecting they could catch them, but the kids, maybe 5 years old at most, seemed more interested in kicking my plastic watering can around and playing in the bird bath. I am more interested at this point in finding someone who can get them and add to their own flock more than I am in finding their rightful owners, but no one else has stepped forward and I'm afraid predators will get them any day. The last I saw them was yesterday, when the children frightened them and they kept their distance.

Another rite of passage: I got my one-time pneuomonia shot last week. It hurt a little more than other vaccines I'd gotten, and that was not my imagination. The nurse said the viscosity of Pneumococcal shots needs to be thicker, for whatever reason. Still, the more I read, the more of a supporter I am of vaccines in general.

Posted in

Uncategorized

|

2 Comments »

October 27th, 2024 at 10:44 pm

Today I noticed a post on my local town FB feed from a woman looking for donations of toiletries and other items to me put into gift baskets, a fundraiser for our regional hospice. I reached out to her and offered her 7 small pieces of my mother's work, which she said they'd be happy to have.

I packaged them up carefully and put them out in my Buy Nothing bin for her to pick up. I thought perhaps I was "over" this happening, but as I cleaned and then packed each item, I felt a melancholy come over me which has stuck with me all day.

It just makes me miss my mother.

I also gifted a few other items so I felt good about decluttering ahead of a possible move in a year or two (or three, if the real estate market doesn't open up).

I also made it to the gym and changed the bedsheets. With Luther not around, I am enjoying the luxury of having nice blankets and throws on the bed, something I didn't dare do when I had cats. Tonight after changing the sheets, I decided to bring out a throw that my mother made probably 60 years ago. I always liked it. The last time I had it out was about 15 years ago when I did a photo shoot with Waldo. But just having that blanket out, much as I enjoy looking at it, also stirs up emotional stuff.

Tomorrow's a shopping trip with planned excursions to Trader Joe's and Whole Foods after I get my first ever pneumonia shot.

So my father and I are back from a 3 day trip to visit our cousin. On the drive down, I got off on an exit where they indicated that restaurants and gas was available to either the left or right. Well, I chose left, then drove for many miles without seeing a single restaurant or gas station. We finally wound up in Shenandoah, PA, where we had a not very good lunch at a pizza joint, but the scenery was probably the best we saw on the whole trip. I was feeling "lost" at the time so I didn't stop to take pictures.

My cousin's grandson and grandson's girlfriend are also living in the house. We didn't really do much but we did have a nice dinner out at the Great American Saloon (great food, lots of taxidermy) and then breakfast out on the morning that we left. It was a loooong drive but really just consisted of 3 interstates and then a local highway. I think it took about 5 hours. Both coming and going, we stopped in Milford, PA where Dido and I have met a few times. Going down, I used the rest room and picked up drinks for us at the Wren Cafe, and on the way back, we had a pretty good lunch at the Apple Valley Restaurant.

Posted in

Uncategorized

|

2 Comments »

October 20th, 2024 at 01:13 pm

So, wow.

On my to-do list was double-checking that my current Part D drug plan, Wellcare, was still a good choice for me in 2025 given that I learned Wellcare will no longer work with Boomer Benefits, the insurance agency that helped me sign up for Medicare.

The huge advantage that Boomer Benefits offers (you can find their very active Facebook page) is that unlike most any other agency, they readily intercede on your behalf should you have a billing issue or some other matter that requires contacting the insurer. I felt this was such a valuable benefit that I decided to enroll in a traditional Medicare plan that was slightly higher cost than the lowest cost plan, solely because the lowest cost plan one did not work with Boomer Benefits.

So since I had to go on the Medicare site to pay my quarterly premium (which comes out to $174 a month, or $525 a quarter), I checked Part D/prescription drug plans for 2025. Turns out my current (Wellcare) drug provider is the cheapest plan based on monthly premium costs + deductible. This year, my monthly premium has been .50; next year, it will be $12.40.

What also makes a big difference, aside from which pIan/provider you choose, is what pharmacy you fill your prescriptions at. I do take one generic drug intermittently on as as-needed basis, which so far has been every other month, and lately I've been relying on Stop & Shop Pharmacy. Based on that rate of frequency, I will never reach the point of paying the $590 annual deductible in full, BUT IF I DID, then CVS or Walgreens would be cheaper than Stop & Shop.

Just by way of example, my lowest annual cost for this one generic drug (on my current plan) is $172, but the same drug/dosage cost $532 on a different plan. Not to mention a big difference in prices between a "Preferred" pharmacy and an "In Network" pharmacy. In the past I never bothered comparing prices between pharmacies. It just seemed like too much of a hassle, but now, with Medicare's convenient pricing tool, you can compare drug costs at up to 5 different pharmacies in your area quite easily.

So it's really important EACH YEAR during open enrollment time to review whatever meds you're on and compare costs on the Medicare site. This is something I wasn't accustomed to doing when I was on either Obamacare or a private employer-sponsored plan where you had no such choices. So I'm beginning to appreciate what Medicare can do for me. It's easy enough to do, though if someone had multiple medications, I can see how things could become more complex.

I've also never tried using my yellow RX card, so maybe next time I have to fill a prescription, I will first try using it to compare costs.

Posted in

Uncategorized

|

5 Comments »

October 18th, 2024 at 01:52 pm

I finally received my IRA CD distribution in the mail this week; it took over 4 weeks to get, which I think is unacceptable. I did file a complaint with the OCC; perhaps that sped things up a bit. Now they're sending me surveys asking me if I'm happy with their service. Unreal.

I had them deduct state and federal taxes, so my net was just about $9500; still, I plan to live on that, and 2 more monthly annuity payments, to see me through the rest of the year. So glad to finally have this behind me.

I've been waiting for someone who was to show up today between 8 and 9 am to look around and provide a price on mouse exclusion. They appear to be a no-show. It's very disappointing how many service providers like this can't seem to meet even minimal requirements for doing business, like showing up.

I got one price already but at $2600 it seems pretty high to me for what they do: putting up a barrier all around the house under the lowermost level of vinyl siding. If I ever wanted to upgrade my siding, it would all be ripped out and a waste of money. I'm not planning on doing that, but still... It bothers me that after spending $2600 they won't guarantee their work unless you also subscribe to their monthly trapping program, which tells me they know that the exclusion alone won't work. Hence my hesitation.

I brought my father to Walgreens after scheduling appointments for both of us to get our flu shots (we already got covid shots, and my pneumonia shot is in another 2 weeks), but I was unable to get mine because I forgot to bring my Medicare card. I was following sensible advice about not always carrying it around, in case you lose your wallet. I've rescheduled my flu shot for this afternoon.

We still waited 50 minutes for him to get his shot because someone had not entered my father's middle initial correctly in their system, and it needed to be a perfect match. Then the home address didn't match up becus my father insisted for years on using his son's address in NJ as his home address. I won't even go into why. So Walgreen's was asking me to confirm the exact home address in NJ, and since my father has trouble standing and walking, I didn't want to make him get up and walk to the counter, and he is hard of hearing, so I was yelling at him dad, I need the exact address and so on in front of other customers. Then he was confusing his current address here in CT with the old one in NJ. Nothing is ever easy.

I'm avoiding going to CVS now because when we were there for our covid shots, they charged my shot to an old insurance provider, even though I gave the guy behind the counter my Medicare card. I only know they charged it to the old provider because I got automated text messages from CVS saying thanks for choosing XXX. I've been waiting to get a denial notice from them, but so far, nothing. Maybe they won't bother? Seems like it will be a hassle to get that straightened out. Sigh.

Today I have nothing specific on my agenda except the flu shot this afternoon, working out at the gym and cleaning up up some tree limbs I cut down 2 days ago. Hoping it will be a stress-free day.

I planted a lot of small trees when I bought this place 30 years ago, and now they've all gotten pretty big. The tree I'm working on taking down now blocked my view of the front yard and also was growing into the fence surrounding my raised vegetable beds, so I decided it should go. Maybe it will help my lawnmower from gouging the lawn in this particular area when the tree is gone.

Posted in

Uncategorized

|

2 Comments »

October 11th, 2024 at 01:42 pm

As of right now, I still don't have the IRA CD distribution I requested from US Bank on the date that CD matured on Sept 12.

After 6 painfully protracted phone calls (with 6 different individuls, of course) and 3 separate trips to the library to fax them their 3 required forms, I finally filed a complaint that was confirmed by the OCC (Office of the Controller of the Currency), which regulates US Bank.

So this morning after noting the passage of another week, I called US Bank to check on status, and they told me the check was mailed out Oct. 7 so I should have it any day now. I almost couldn't believe my ears and asked the rep to repeat what he said. Interestingly, the email confirmation of my complaint by OCC was on Oct. 7, so I am thinking that complaint really moved the needle on what has become a horrendous customer experience with an inept bank.

I can't wait to ditch my credit cards with them, but want to wait til I deposit the check.

Posted in

Uncategorized

|

1 Comments »

October 7th, 2024 at 09:07 pm

I had my mason over here a few days ago to repair a crack in my foundation. He had told me earlier it would cost "a couple hundred." I'd been trying all summer to get him over here, but I knew it was a small job and that he'd probably rather focus on the big jobs first.

I was just about ready to move on to someone else but he finally came through, sending his father, who is part of his crew, to do it.

I texted the mason later that day and asked him what I owed him. He said "No charge!" since I've referred him to others many, many times. Yay!

That's helpful, since I have just $1300 left in checking and no idea when I'll get my CD from US Bank that matured Sept. 12. . I am so aggravated with them that I filed a complaint with the OCC (Office of the Controller of the Currency) as they are the ones that regulate this bank.

Posted in

Uncategorized

|

3 Comments »

October 6th, 2024 at 02:05 pm

Plenty to do today, but I'm procrastinating a bit.

It's been a while since I've posted pix of my gardens, so thought you'd enjoy seeing what's in bloom here now.

This is a low-growing wood aster.

These are Autumn Joy Sedum with mums (not daisies).

This is a buttonbush I planted last spring. It's a small, native shrub that gets beautiful pure white gumdrop-looking flowers in summer that turn into these seed pods later in the season that feed wildlife.

These are snowball hydrangea flowers that start out pure white in late summer and gradually turn a bronze-pink color. It was once a small tree but it was toppled by a storm years ago and now it's more of a multi-stemmed shrub, as vigorous as ever.

These are hyssop in the back, a total bee magnet, and cosmos in front, which will bloom from early summer til frost. Such an easy, carefree flower.

This is white snakeroot and sneezeweed. I love the late-season color when many other plants are spent.

More wood aster, such an important native fall pollinator plant that grows freely around here with several different species.

My main Autumn Joy bed, photo taken in mid-September. The flowers gradually darken.

This is blue mist flower, a native that popped up in my veggie raised bed, which I then transplanted to a more suitable spot. It has already spread a bit in just one year.

This is bluebeard. Not a native (it was mislabeled by the grower) but gorgeous nonetheless and popular with the local native bees.

Milkweed seed pods

Sneezeweed with bumblebee closeup.

Tatarian aster is not native here in the Northeast, but....It gets to be about 6 feet high unless you remember to cut it by a third mid-summer.

Posted in

Uncategorized

|

3 Comments »

October 2nd, 2024 at 07:53 pm

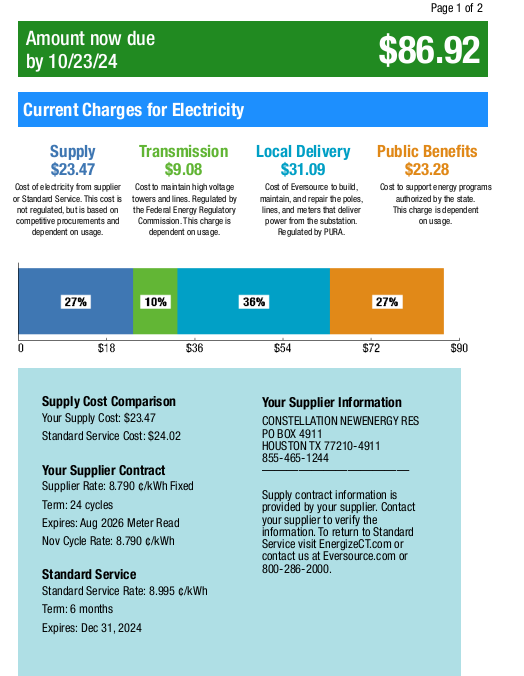

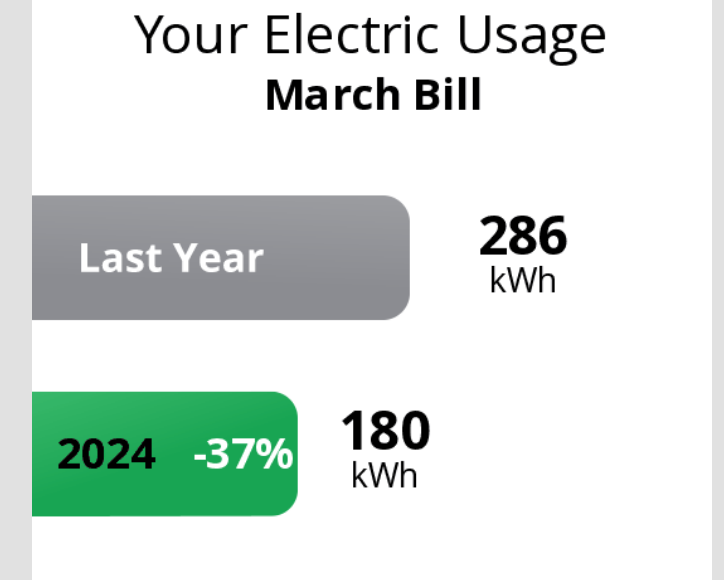

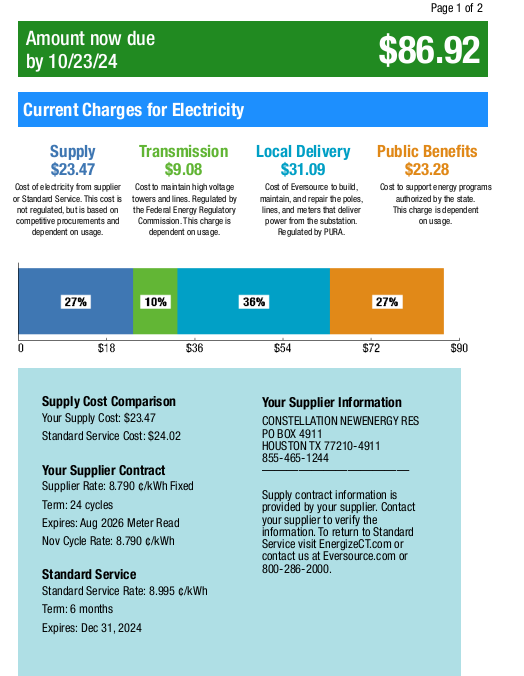

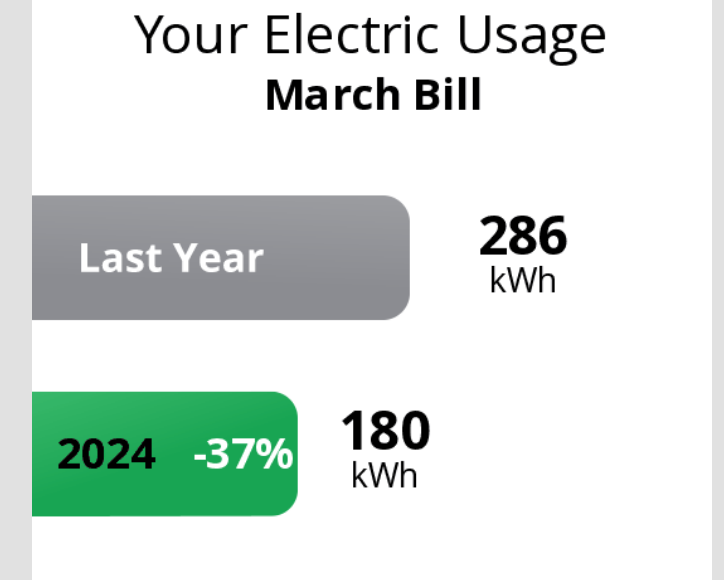

Here's my most recent bill. People all over the state are up in arms right now because the Public Benefits charge, which allowed people to not pay their bills during covid, shot up. It also covers the cost of new EV stations? I believe these higher charges for the rest of us will last for 10 months. People are furious.

Anyone in my state would think this bill is great. I have seen people in my town's FB page post bills of $900 for a month! But then upon closer inquiry, you learn they have a heated swimming pool or Jacuzzi.

Posted in

Uncategorized

|

3 Comments »

October 2nd, 2024 at 01:34 pm

I still don't have my $12k from an IRA CD that matured on Sept 12. I'm down to about $400 in my checking account.

Had another stressful conversation on the phone with them just now. Two weeks ago, they promised to "expedite" the distribution, but here I am, still waiting for their snail mail check to arrive because banks don't operate in the 21st century. Apparently they don't believe in direct deposit of funds (they consider that a transfer, not a distribution), nor even email to send me forms to fill out; had to make 2 separate trips to library so as to use their fax machine to return said completed forms to them.

Today's rep sounded competent, so fingers crossed...but so did the last rep. She emailed her supervisor, her supervisor's supervisor and a few other people to expedite it a 2nd time. She said she saw it had been "disbursed" but not "redeemed" or "processed." This is bank code for let's slow down this process for as long as possible.

The customer service manager is supposed to call me today by 1:30 pm and a cashier's check may be overnighted tonight. The key word being "may." They acknowledged this was a banking error and said it was a "coaching opportunity" for them. However, I have a doctor's appointment scheduled for tomorrow morning, and it being less than 24 hours from then it is too late to cancel it without being charged. The bank will probably want me here to sign for it, so I don't know. Maybe they can have it delivered in the afternoon.

It's really messed up my cash flow. I know I can take an IRA distribution from other sources but prefer not to do that for various reasons. And becus I am stubborn. Banks can accept your money in about a half-hour when you purchase a CD, but getting it back should not take a month and all this aggravation.

Will they be paying me the interest for the additional weeks they've held onto my money? I don't think so. So they are making out financially by dragging their feet.

Last night I finally heard from my mason; I've been asking him all summer to repair the crack in my foundation, but it's a small job, so I think he kept putting it off in favor of higher paying jobs. Now he wants to do it this weekend, which is great, but it will be a couple hundred dollars, putting me perilously close to zero in my checking account.

But wait! I forgot that since we're now in a new month, my monthly annuity payment should show up in my checking account by tomorrow. The annuity saves the day!

Regardless of that, I will be cancelling my US Bank credit cards and will never do business with them again. Even though that will surely zing my very high credit score because between the 2 cards, my credit card limit with them is over $20K.

Or maybe what I'll do is apply for a new credit card with an upfront bonus of $200 or $250. Once that card has been secured, I will cancel just one of the US Bank cards and see how that impacts my credit score. If it's not too bad, I will cancel the other one in short order. No use shooting myself in the foot.

Posted in

Uncategorized

|

2 Comments »

September 20th, 2024 at 11:50 pm

I had an IRA bank CD maturing Sept. 12. What a pain in the butt trying to get a distribution. They make it so easy to open one, but gosh, seems like they try to put up as many roadblocks as possible to prevent you from accessing your money.

They wouldn't accept a phone call from me a few days ahead of that as to what I wanted to do with the CD; they said I had to wait til the day of maturity and then i had just 10 days to let them know what I wanted, or it would renew again for another 5 years at 2.something%. Nope, nope, nope.

The US Bank rep insisted that if I wanted it transferred to my bank checking account, that they wouldn't consider that a distribution, and that if I wanted a distribution, they'd have to mail me a check. Yes, snail mail.

I filled out all their paperwork and was told I had to fax it to them. Not email. Special trip to the library to do so. The following week, they send me a snail mail letter saying I failed to complete their transfer form and they were returning my application to get the distribution. Which they hadn't included with the other forms they sent me to complete and return. In the letter they said to complete and return the form in the enclosed postage-free envelope. Except there was nothing else in the letter!

So I had to call them again, and that was when I learned they don't consider a transfer to my bank a distribution. Egads.

They promised to expedite my case once I resent the original paperwork (another trip to the library fax machine) and handwrote in, "Mail me a check." Meanwhile, I have just about $1600 left in my checking to cover the bills.

Much of this back and forth could have been avoided if their forms were clearer. But I know from having worked for a large bank for a few years that banks seem to want to minimize the information they provide to customers, about anything. They are very secretive. I used to work in customer communications, writing a wide variety of letters to customers about all sorts of things. They were always less than transparent. Hated that whole vibe.

Yesterday was an extremely busy today. In addition to battling with US Bank, I also struggled to assemble two kitchen dining chairs I bought from Bed Bath & Beyond. There really wasn't much assembly, but I got stuck with this square metal piece that is supposed to let you swivel in the seat. You couldn't screw a screw in the 4 oval holes in the metal plate and i just couldn't figure out how I was supposed to attach it to the chair. The assembly instructions consisted of only diagrams, no words.

Every time I communicated with BB&B, I'd have to wait a day for a different rep to email me back and they seemed unable to let me talk to a technician would could walk me through it on the phone. They said I could return the chairs for a refund or find a handyman to put the chairs together. I FINALLY figured out by myself that the square metal piece could be pulled/pried apart/rotated, revealing an additional 4 holes and another metal plate that you're meant to attach it to the chair with.

I got in a 35-minute walk with my weighted belt, reorganized my dining linens (tablespreads, placemats, runners) and was able to gift some and donate others to good will. Now what I had left (mostly my mother's things) could neatly fit in the storage bench.

Also yesterday I was interviewed over the phone by a news reporter about knotweed, the focus of one of the group's I volunteer with. She had a very tight deadline, and by the time I called her, she only had 2 hours, but we spoke at length and today I saw the story published online. What's great is that Hearst News owns not just one daily in my state, but a whole bunch, so the story appeared in every one, plus a bunch of weeklies and a monthly magazine and various online news outlets to boot.

So in one feel swoop my group just got a whole lot of exposure. I shared the links with the other board members and everyone is thrilled. It really gives us a lot of "cred," and being a relatively new group, this recognition is very helpful. Finally, yesterday, I somehow managed to wash 3 windows here, inside and out, as I had noticed a while back how dirty they looked. I also washed the trunk liner in my car, ahead of my planned trip to visit DIDO next week!

I am very much looking forward to this trip (rain or no rain) as I haven't done anything like this (mainly, becus of my cat) for a very long time. It will be refreshing to have the change of scenery. We're about 2.5 hours apart.

This am I went driving around with another board member of the knotweed group. We were looking for homes that have knotweed and making a list of their addresses. We plan to write and then mail a simple brochure asking people, Do you have knotweed, then explaining how to ID it, why it's bad and what they can do. It's a unique plant in that it's not easy to kill, and all the usual methods, like cutting it, mowing it or digging it out will actually make it spread worse. It has to be treated with herbicides. Preferably by a licensed applicator.

We are a small group of local residents, so all we can do is raise awareness and educate people (both homeowners as well as public works employees) about management best practices.

I worked out at the gym in the afternoon, but otherwise, that's about all I did.

I'm supposed to do a litter cleanup at a beautiful beach/preserve tomorrow am but it's over an hour away and they want everyone there by 9 am. Which is feeling more and more doubtful.

Posted in

Uncategorized

|

12 Comments »

September 12th, 2024 at 10:09 pm

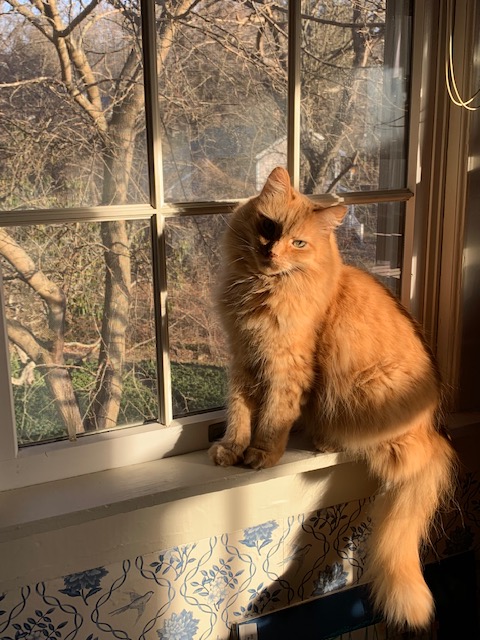

It's hard to say goodbye after 17 years.

Even if you knew it was coming.

I took him to my old vet, not the new one, because I remembered how good he had been with Waldo at the end, 8 years ago. The staff were caring. Luther did not seem overly frightened from the car ride or the barking dogs as we awaited his sad fate together. There was a small window that looked out on the parking lot, and beyond that, a bit of woods, and together we looked out that window for quite some time, given some privacy before the end.

Not much more can be said right now, except my heart feels like it's been ripped out.

He was a good boy, and he had a good run.

Posted in

Uncategorized

|

11 Comments »

August 31st, 2024 at 08:42 pm

I spent a wonderfully productive couple of hours this afternoon organizing my kitchen to be more attractive to a prospective home buyer. Suddenly, a layout that worked for 30 years seemed cluttered and unattractive.

I only made a few little tweaks, but what a difference. Remembering how positively meticulous and clean the homes at every open house I've attended looked, that boxy oversized toaster oven that was my mother's, stuck in a corner next to the stove, was too much. I mainly use it to bake salmon, but decided I can do that in a frying pan, stovetop. Once in a great while I roast garlic in it. I liked using it because it used less energy than my full size electric stove, but it's been a few years since I used it to cook raw oats for my homemade granola or toast nuts and I cook sweet potatoes in the microwave, I have less and less use for it. And I really don't eat much toasted bread.

I cleaned it up as best I could and offered it on Buy Nothing and had a quick request for it. Done! The cute set of 4 Pottery Barn ceramic pumpkin plates that I got myself on Buy Nothing but never really used, I decided to offer on Buy Nothing and got about 10 people vying for them. Perfect timing and great for kids.

The other big appliance taking up counter space was my microwave. It's a smaller size, and believe me, smaller than the one I used to have, but still, not especially attractive on the counter. I have a large kitchen cabinet which curiously has an electrical outlet on the back wall inside it; there must've been a remodel at some point. Anyway, my fairly compact microwave fits in there perfectly, and voila! I don't have to look at it on the counter. And with some further organizing, I was able to fit all my food items back in this cabinet, which I remember the listing agent laughably called a "pantry." I composted an ancient jar of corn starch, a smaller jar of garlic powder that expired a year ago and set aside an unopened jar of fake maple syrup for my friend's mother.

This was just a spontaneous thing I started doing when I got home from a gym workout. I really like tackling little corners or rooms of the house like this...so it doesn't seem so overwhelming when the time gets near to list it.

In other news, I ordered a navy blue , la t-shirt off Amazon that i planned on wearing while marching in the parade Monday, but I somehow ordered a men's size x lg and it's way too big on me; they don't want the return but refunded me for the purchase, so I plan on bringing it with me and offering it to someone else in our group who may want to wear it for the parade and then just keep it.

I'm down to just $1,000 ($1900 as of Sept 2 after monthly annuity payment), which has to last me til my CD matures Sept. 12. I'm not expecting any more big credit card bills, so I should be okay. That CD is $12K, and I plan to make that cover all my income needs for the remaining 4 months of the year, along with my annuity. So that's about $4k a month, doable.

Posted in

Uncategorized

|

5 Comments »

August 18th, 2024 at 10:36 pm

We had torrential rain all day today and now, half the roads in town (including the interstate and other state highways) are closed or washed out. The meandering river that flows through the heart of town is now a force to be reckoned with; I do believe one storefront may have to be torn down as the water overflowed the river banks and the structure, as seen from drone footage someone took, appears now to be IN the river.

I'm seeing cars floating in what was the road, abandoned by their drivers. People on our local FB page opening up their homes to others who can't make it home. They have declared a state of emergency.

I am counting myself extremely fortunate as last I checked my basement remains dry. I attribute that largely to the fact that when I had my back paver patio rebuilt, I knew the grading was bad and specifically asked my mason to slightly tilt the pavers, which run the length of the house, away from the house as much as possible instead of making it level. This turned out to be very effective in keeping water from accumulating near the foundation, and instead it funnels it all down to some old stairs i have which lead to my driveway, and there is a downward slope to the drive, so the water all eventually runs toward the street and storm drains installed there.

Feeling stir crazy, I had actually really wanted to go to my gym, which is just a few miles away, but I'm glad I didn't as they did close that road as well. The sirens have been nonstop since mid-afternoon.

I'm going to cancel an appointment I had Tuesday morning as it may take a while for these waters to recede.

Posted in

Uncategorized

|

3 Comments »

August 12th, 2024 at 12:12 am

Well, this is entirely not money-related, but I do feel a great sense of accomplishment/satisfaction since I was able to basal bark treat 4 small tree of heaven saplings. Tree of heaven is one of just 2 plants i can think of that absolutely must be treated with an herbicide to eradicate. I learned this the hard way; each time I cut it down, it not only came back, but several more sprung up in the vicinity.

So that makes a total of 10 tree of heaven saplings I've been able to treat this summer. I have until early October to do as many more as I can. The real challenge is beating a path to each sapling, which are growing in heavily brushy areas I usually avoid this time of year due to ticks.

I'm not sure how many more I have....at least a few...plus the big tree that needs to have the "hack and squirt" method used. Then you wait 30 days, then cut down only when completely dead.

I've been completely inactive when it comes to yard work for about 3 weeks now. While we had lovely weather in June, July and August have been oppressively hot and humid. This was the first day I've been able to do anything, and since this decent weather is supposed to hold at least til the end of the week, my goal is to do something in the yard each and every day. I have 3 ironweed plants and a gooseberry that have been in pots all summer and really need to go in the ground, but clearing areas where they go is a ton of work. Must be done!

But going after the tree of heaven is a top priority.

Here's an update on my cash flow situation since my last post: my checking balance has shrunk to $3583, and that needs to last me for another 4.5 weeks. I will get an infusion of $932 Sept 2 from my annuity. I should be able to stretch it out until the CD matures.

I've been picking tons of cucumbers and tomatoes. I'm only growing cherry tomatoes and a yellow grape hybrid. I've gotten a decent amount of yellow squash, and my stringbeans should be developing beans any day now, since they're flowering. I've given extra cucumbers to my father, who likes to pickle them, and my friend/neighbor R.

My knotweed group is meeting on site this week at a popular walking trail in town where a smallish patch of knotweed has been sighted. We will make it a demonstration plot, mowing one side and then cutting and then treating the other side with herbicide, with instructional signage designed to show residents walking by that mowing alone won't be effective.

Still going to the gym 4x a week.

This, in a nutshell, has been my summer.

Since coming to the realization that I need to move, I've been looking around here with different eyes. With thoughts about staging the house, eventually, and still working to give things away for less clutter. Today I posted a rather beat up old rattan chair that I acquired from Buy Nothing, but no one wants it so to the dump it goes. I have a sentimental thing for rattan, a hangover from growing up with my grandparents' complete patio furniture set, all rattan.

I think it was actually something Dido said that made me realize I was just fooling myself by saying I was going to "age in place" here. The yardwork, or my inability to care for the property the way I think it should be, would likely always be a source of stress for me. I want to do other things with my life. I was telling my father of my decision and he surprised me by telling me his opinion, which was that I shouldn't move. He hardly ever insinuates his opinion about anything, so for him to say something was unusual. Basically, he said you have everything you want in your house now, and the yard is only a source of stress because I allow it to be so, and that most people would not be so focused on invasive plants, etc.

That doesn't really change how I feel about things though.

These comments were made on the same day that he confessed his regret about selling his beautiful home on the Jersey shore, which he'd made so many improvements to, to live in a small studio apartment on my sister's property. He decided to try renting out the home for a while (which I would never have done, given the distance between that house and where he moved to), and unfortunately, he failed to do a background check on the woman who someone at his favorite diner said was looking for a place. She was late with the rent from the get go, often not paying the full amount. He had to start eviction proceedings and she stole things he left in the house. (Carelessness on his part, I have to say.) Because she had no assets, his attorney told him it wouldn't be worth pursuing in court. An all-round unpleasant experience that I got to experience as well since I had to drive my father down to NJ a few times to meet his attorney. Sigh. Well, that's all in the past now.

Posted in

Uncategorized

|

1 Comments »

August 6th, 2024 at 09:50 pm

I brought my father to physical therapy this morning, then took him out to lunch afterwards. I drove back home around 2 pm. When I walked in the front door, my cat immediately began meowing to be fed, and when I walked into the kitchen, there was a funny noise coming from the basement that sounded a little different.

Wondering if either my central air or my new heat pump hot water heater was malfunctioning, I went into the basement to find about half the basement floor covered in water and then, shockingly, I saw that the cause of the sound was a burst pipe where water was gushing out.

I was able to stop it by turning off the water for the whole house. There was plenty of water on the floor, but judging from the amount of water, it seemed that it had only been gushing out for 5 or 10 minutes. That's why I think if I had arrived even 20 minutes later, I would have had a REAL mess on my hands. I can't imagine what I would have found if I had been away for a much longer time period. This is the kind of thing you just can't prepare for; it just randomly happens.

I started calling plumbers but all I was getting was answering machines. Since I had no water in the house now, I didn't want to wait around for someone to call me back, so I kept calling til I found one right up the road that I have never used. He said he could come over in a half-hour.

I found the cap that had burst off the main water line on the basement floor and showed him. He told me it was quite old because it was made of iron, and nowadays they are made of brass, and said that it was the wrong type to have been used on my water line. It was an easy fix for him. Since he was there, I showed him some copper piping that was pretty badly corroded and he said since the burst pipe didn't take up the full hour, he could fix the copper corroded pipes for just an additional $38 (materials), so I had him take care of that too. A good thing to do since I'm planning on selling the house now. All told, I felt kind of fortunate to have only had to shell out $213 for this unexpected emergency.

While he was here, the other plumbers I had called started calling back, and the wife of one of them texted to tell me that her husband and assistant were on their way, but I was able to tell her I already had someone here. At least now I know these plumbers do respond fairly quickly to emergency situations.

In my town, if you ask someone whose a good plumber to call, 85% of the time you get 1 of 2 plumbers who are mentioned again and again. It's like they have a lock on the town. There are plenty of other plumbers, but they are recommended less. As a result, these top 2 plumbers charge a premium, it seems. I have used them both; they were both competent, but I had issues with both of them, aside from price.

So I was happy with the plumber who came here today and will call him first should I have a need moving forward.

I'm running my dehumidifier down in the basement now to dry it out. All the water also flowed into my adjacent garage, and for the first time I used a wet vac I had bought for just this kind of emergency. So I got most of the surface water sucked up and now it's just wet concrete. I had a 5 x 7 cheap indoor/outdoor rug in front of the washer and dryer which I guess I'm going to have to toss since with this humid weather it's not going to dry out anytime soon and will probably get moldy. There's also an old draft dodger my mother had made for me that got soaked as it was in front of the basement door, so guess I'll toss that too.

You think your life is orderly and you're on top of everything; it's disconcerting to realize life will always throw you curve balls and that you can't organize every possible curve ball away.

Posted in

Uncategorized

|

2 Comments »

August 2nd, 2024 at 11:43 pm

All of the high cost bills I mentioned recently have been paid, save for the paint job of the garage ceiling ($366), which will happen next week. My taper finished retaping it today, so not only has that bill been paid, but also my car, homeowners and umbrella policies and my property taxes. I used two different agents to try to get better prices fo the home/auto policies, but in the end, my current policies were more affordable. They had risen substantially, but apparently not as substantially as The Hartford or a host of other insurers would like to charge me.

So that means I have $4,107 left to live on until Sept. 12, when my IRA CD matures. SEEMS reasonable. That includes about $935 after taxes on my annuity payment this month. I already shut off the Vanguard dividends income stream since I planned to obtain income from the IRA CD instead, all in the name of keeping my 2024 income low. The CD is about $12,000, and after trying unsuccessfully to have it rolled back to my Vanguard account 5 years ago and then getting stuck with where it is now at a lower rate for ANOTHER 5 years, I figure it will be simpler to take the distribution. I called them to see if I could notify them in advance I'd be taking a distribution on it, but she said I would have to wait until the day of maturity, and then I have just 10 days to tell them what to do. This was originally a State Farm CD, and then US Bank apparently acquired this part of the business. I am anxious to get my $$ out of there.

I have a birthday coming up very soon but won't be doing anything special except for a litter cleanup with the group I volunteer with, at a beach about 35 minutes from here. On the way home, I may treat myself to lunch out somewhere, and when I get home, I'll go to the gym. Business as usual!

My cousin in PA shipped me my B'day present from Amazon, but inadvertently sent me 2 packages (an air fryer and chichuahua meds) he intended for himself. He asked me to give him a day this week when I'd be home all day, so I picked Tuesday, a day that came and went with no sight of a UPS driver to retrieve the package. Which was a little annoying becus I did have things to do that day. I rarely have a day with nowhere to go. So looks like I'll be holding onto the packages until he makes another trip out this way.

I heard from another cousin who had been living with her husband in upstate NY, who had moved to Utah to live with their daughter/son? about a year ago. At the time, she had said everything was great, it was a big house, etc., but apparently things weren't so great after all because when she texted me a Happy Birthday, she told me they are back in NY state and plan to start house-hunting in North Carolina to be near their grandchild. Well, NC is closer than UT, and I would like to meet her someday. We discovered we were related via Ancestry.

I received a little gift from another wonderful cousin in NJ and I need to call and thank her for it.

My friend R., the baker, always bakes me whatever kind of cake I want to mark the occasion, but this year I requested dark chocolate chip and walnut cookies. Built-in portion control.

Posted in

Uncategorized

|

3 Comments »

July 29th, 2024 at 11:09 pm

Tonight was my little presentation to the local Rotary Club chapter to talk about a group I've been volunteering with, the aim being convincing them to partner with us on an upcoming litter cleanup event, which is what we do.

Now, I need to give you a bit of history. All my life I've been petrified of public speaking. I guess it all started in high school when I had to give little presentations of one sort or another. I would turn beet red, sweat and even my voice would shake a little. All the boys would snicker. I hated it. Which led me to a lifelong fear of public speaking. When I was in law school, I knew I'd need to do some public speaking at the end of the first year, in front of 3 actual sitting judges. Somehow I fumbled through it. In various jobs to follow, I did everything I could to avoid further public speaking, and most of the time, I succeeded in avoiding it. I didn't feel good about the avoidance behavior, but I felt I would never, ever feel comfortable doing it.

Here I am, decades later, and I ran into the husband of a woman whose nonprofit I used to be involved with. I had taken my dad out to lunch at a local restaurant, realized who this man was, and introduced myself as dad and I were leaving. He is a Rotary member. One thing led to another and he said your group and my group should team up on a litter cleanup, and I agreed.

What I didn't anticipate was his invitation a month or two later to speak to the Rotary about my group so they could decide as a group if they would do this. Even with my public speaking phobia, I accepted. It was almost as if I knew this man didn't know anything about my background or my public speaking phobia, so I would "pretend" to be someone else: a confident woman who can speak to a group with ease. Fake it til you make it, as they say.

I sensed that something about me had fundamentally changed. It could quite simply be the passage of time! At this point in my life (60-something) I really don't give a s*** what other people thing of me, and I also have greater confidence in myself, and that I have an important message to share about my group. So I agreed to do the presentation, although I did invite some of my fellow board members to join me, knowing they probably would say no since they don't live in my area. And that's what happened.

So I definiely over-prepared for the meeting, rehearsing my little spiel to make sure that any kind of stage fright would not send my prepared talking points out of mind. Everything actually went very smoothly. Maybe I talked a tad too fast, but that was it. It helped that it's a restaurant that I'm very familiar with and is in fact the one where I met the Rotary guy with my dad. And everyone was very welcoming, introducing themselves before the meeting started, offering me beverages and even to share the meal with them. The guy who invited me to talk said nothing about that, and said that I would be talking during their dinner, so I assumed I would talk and leave. But once they realized I'd already eaten, they let me present before their meal began so I could get out of there.

I said everything I wanted to say and really felt rather unafraid. It was just amazing. A small group, maybe 20 people, and one of them was taking my picture with the head of the group for I guess the local paper. There were a lot of questions afterwards and people were raising their hands waiting for me to call on them and i wasn't even really focused on that at first as I'm not used to being in that position.

I can't tell you how liberating it is to feel I've conquered a lifelong fear. I feel I can do anything now. I have finally grown up.

Posted in

Uncategorized

|

4 Comments »

July 25th, 2024 at 01:13 am

I called my Medigap insurer to see if my current gym is in their network for their "Active and Fit Direct" gym discount. Unfortunately, no. It's a small discount. I did submit my gym for consideration for their network.

It would have been nice, BUT. When I was choosing plans with my agent, this insurer was NOT the lowest cost for Medicare Plan N. (Once you choose a type of plan, which is lettered, all insurers by law must cover the same services; only the price is different.) The insurer with the lowest cost was not a company that my particular agent dealt with. The cheaper plan was cheaper by $11 a month ($132/yr, or $2,640 over the next 20 years).

That amount of money is not a deal-breaker for me. I chose the higher priced plan simply because the agency I was working with provides a lot of value-added services beyond helping you sign up for your Medicare or Advantage plan and helping you do all the research involved with that. They also will help you dispute bills you don't think are accurate, which could be really helpful, among other things. So for that reason, I went with my current choice.

So next week I am making a presentation to my local Rotary Club about one of the groups I volunteer with, the litter cleanup group, so that they can partner with us, hopefully, to do a cleanup event in my town. They will have a dinner meeting at a local restaurant. Since they didn't invite me to share a meal with them, I assume I will just go there to make my presentation and then leave, which is fine. Public speaking is something I avoided all my life, but I think I may have reached a point in my later years where I don't give a s*** what other people think of me, so I feel freer to say what I think, and I guess somehow that percolates down to making a public presentation.

So I am reading the huge Medicare & You 2024 to see what's covered, what's not. This, after learning they don't cover routine bloodwork during a physical. Medicare DOES cover cholersterol/lipid/trigylceride blood screenings for cardiovascular disease once every 5 years only. Interestingly, they only cover acupuncture for chronic low back pain. They only cover pelvic exams once every 2 years, not annually, unless you are high risk.

So I was driving home on backroads from somewhere and realized I'd be driving by a creamery that has the best ice cream in town. I made an impromptu turn into the parking lot when I saw relatively few people there. We actually have a Facebook page for people to report how long the line is. Today, there was no line! My father loves their coffee ice cream. He has to stick with sugar-free variety. They only have about 5 different sugar-free varieties, and they rotate the flavors around so you never know what they'll have. As luck would have it, today they had coffee. I got 5 pints for dad! And a pint of vegan mint cookie for me.

He will be so surprised. He hasn't asked me all year for their ice cream, which is unusual. I think he knows I hate waiting in line.

Posted in

Uncategorized

|

2 Comments »

July 19th, 2024 at 12:36 am

This is to be the last year of enforced frugality since I intend to ensure my health insurance remains moderately priced. To do that, I have to limit my overall income to around $37K for the year (even tho I start Medicare next month), and for the YTD ending in June, I only grossed about $12,000 in taxable income for the 1st 6 months of the year(!) if my numbers are correct. That would be my monthly annuity and some dividends/cap gains from 3 of my mutual funds. Plus I also got some decently sized state and federal tax refunds earlier in the year so that was used for living expenses and kept in my checking account.

I haven't had to do any IRA distributions so far this year, but the 2nd half of the year would likely require a cash infusion. I hadn't planned on doing any home improvements this year, besides the heat pump hot water heater I did in January, since taking more distributions would boost my reportable income. But then after getting a garage door repair that put some holes in my garage ceiling, I knew I wanted to have that ceiling retaped and spackled. It's been an eyesore for years and needs attention, and those holes will allow entry for mice if I don't cover them.

So to cover this upcoming expense, I transferred most of what remained in an online money market acount so it would have no impact on my reportable income for the year. I think I'm paying $1600 for the garage ceiling redo.

I have been avoiding unnecessary purchases, but my checking account will eventually dwindle, so what I would like to do is direct my $12K IRA 5-year CD, which is maturing in September, to my checking account as a distribution when it's mature. I had wanted to do this in the prior 5-year CD term when it matured and was still with State Farm Bank, but trying to get the paperwork from Vanguard in a timely manner to do a transfer just didn't happen and I ran out of time, so I was stuck with ANOTHER 5-year term, and then State Farm became US Bank, or at least my CD became theirs.

I figure taking the distribution directly in my checking account will be much easier as I won't have to rely on Vanguard to do anything. So the $12k will be more than enough to cover my living expenses for the remainder of 2024 and still keep my income very low for the year. At least I think so. I just need to get thru August and another 2 weeks in September with about $4500 remaining in my checking account after paying for the garage ceiling and car/home insurance. It could be close. I also went ahead and stopped auto distributions of those Vanguard dividends/cap gains funds to my checking, becus that could push me a little beyond the income I want to be at, and it's hard to control income when each distribution is a different amount. So if I need more $$ toward year's end, I could do a small IRA distribution.

Posted in

Uncategorized

|

6 Comments »

July 15th, 2024 at 02:44 pm

So I'm eating my morning breakfast cereal today, as I always do, when, after 3 or 4 spoonfuls of deliciousness, I look down at the bowl to see what looked like an earwig resting at the top rim of the bowl, on the inside. Like it had just crawled out after being submerged in soy milk.

EWWWW.

I had to dump it. It just grossed me out. Since the blueberries came from a frozen bag and I'm pretty sure it didn't come from the half gallon of soy milk, it must've crawled into to 1 of the 2 glass cereal canisters I keep on the countertop (mason-type jars), OR the bag of raisins OR the glass jar of walnuts. I checked each to be sure there weren't others.

I very recently decided to divest myself of a lot of unframed art my mother had created. To sell it, I would have to frame it, and many of these people were quite large (like 2 x 3 feet), making framing not only very expensive but also very heavy and unwieldy.

So I decided to gift close to a dozen pieces on my Buy Nothing group (where you can just acquire just about anything, from a canoe to a set of dishes to yes, a work of art).

I wasn't sure there would be much interest in my mother's modern/abstract art, but I have been gratified to see how much interest and appreciation there has been. Much of my mother's work sat in storage in a spare bedroom for the past 8 years. I only have so much wall space. I have sold some of her work and donated other pieces, too, but I am gifting the unframed stuff. The room is by no means cleaned out, but I still felt a great sense of lightness having taken some concrete steps to do something with the art. Better they go to people who can enjoy and display them than sit gathering dust in my spare bedroom.

I do feel pangs of regret parting with some of it and it's definitely got me thinking more about my mother. I also wonder if I'm going to regret doing this later. I think she would understand, but still, I do feel a certain sense of loss and dare I say, guilt, in giving these away.

The other thing I tackled yesterday after thinking about it all year was herbicide treatment to kill tree of heaven saplings that popped up all over the property after I tried cutting them down several years in a row. This is one of a handful of invasive plants that MUST be treated with herbicide. It's also a host plant to the spotted lantern fly.

I had to mix the herbicide with an oil (for better adhesion), then add food dye so I can keep track of which saplings I've treated. There are probably a few dozen here. (I'm also keeping a written list with the date, since you need to wait 30 days for it to die before cutting it down.) Cutting it down before it's dead will stimulate it to spread even more. Anyway, I knew I had just one day (yesterday) to get started on this before the heat wave returns for most of the week. I waited til 4 pm but it was still hot as heck, and you have to wear long pants, socks, long sleeves, and mask. Because I had to clear all the vegetation surrounding the tree of heaven, including poison ivy (most all located in the brushy perimeter of the property), I was only able to treat 3 saplings in 2 hours.

The optimal window for doing this treatment is between mid-July and September, when the plant is sending sugars/carbohydrates down to its roots. If you do it another time, it won't be effective.

I'm getting too old to have to do this kind of thing. Which is the reason I've also been thinking in recent weeks (again) that I should sell this place and move to a condo. The challenge now is the really tight real estate market. My greatest preference would be to remain in my hometown here, but it never had a lot of condos, and with this market, even fewer listings.

My second choice would be a particular complex in neighboring town (where my dad lives now) but it only has about 90 units and there aren't usually more than a handful on the market at any one time. I also like the units in the much larger complex (several thousand!) nearby it, but there are 2 problems with that complex: the garages are detached and a bit of a walk to your unit, so not so nice if you're carrying groceries or it's raining, and 2) the common charges are quite high, like $700 to $800/month, due to the extensive landscaped grounds. It's like a small village unto itself. The units at the small complex that I like has attached garages and look very much like single family homes, each unit with its own yard and very private back deck or patio, usually fronting woods.

I've even been looking for updated ranches on small lots in my hometown, but not much of those, either. I won't buy a fixer upper at this stage of my life. My worst fear is that my home would likely sell fairly quickly, but then I'd feel pressured to buy something I wasn't really in love with, or feel pressured to buy when there simply weren't many choices. I don't plan to move again, so it needs to be a great fit.

So thoughts of moving sometime in the next few years are part of what's driving my divestiture of art work. I've been very slowly decluttering household items, and have made a list of maintenance/repairs that I feel should be done before I put anything on the market. I am hoping that I could wait out the tight inventory market and that things will improve in a year or two, but I don't really know.

I've done some cost comparisons of certain expenses like property taxes, lawncare, snow removal, monthly condo charges, etc. Even though my favorite condo in neighboring town includes TV and Internet in what its common charges cover, I still would be paying roughly $4,000 more a year to live in a smaller condo than here in my freestanding home. And that's before factoring in senior tax credits for my hometown. (There are both state and local senior tax credit programs, but even the more generous town program in this neighboring town has an income limit of just $53,400; my current town has a more generous income limit.) Probably becus I really do live pretty frugally here, still shoveling my own snow, which I know I can't do forever. And I don't pay any monthly fees for TV.

I just have been realizing that, not only is the care and maintenance of this property something I'm not doing a very good job at (and likely never will), but it also takes up an inordinate amount of my time when, increasingly, I'd rather be doing something else, plus it's become a source of anxiety knowing stuff needs to be done but I'm not doing it, often due to tick season or extreme heat making it very difficult. My feelings were different when I bought this place at age 36, when I embraced all the yard work and enjoyed it. Sigh.

Posted in

Uncategorized

|

9 Comments »

July 10th, 2024 at 01:26 pm

I think this is about as near perfect a credit score as I've ever had: 100% on-time payments, a 33-year credit card payment history and well over $100K in available credit while only utilizing 1%.

Once I paid off my mortgage in 2012, I didn't think a credit score would be that important to me anymore since I didn't see myself needing it to buy another home or car. But, you never know. I plan to purchase a new vehicle next year; it's unlikely Toyota would see a need to offer 0% or 1% financing, but you never know....

Last night around 7 pm I saw a bobcat passing through my back yard. Not the first time, but the first time since September 2022. I do have a litter of 5 baby skunks with a burrow in my yard but disappointinly have not seen them since they made their first appearance a week or so ago when I was weeding. The are the cutest things. When they are this young, they all "walk as one."

Girls night out last weekend at the vineyard was cancelled due to the weather. We're now setting our sights on an International Festival in nearby small city that is mostly centered on live music and ethnic foods.

Dad and I went to lunch at a certain restaurant near him. The bill was $90 before tip. I think that's the last time we go there. It's good, but actually sometimes hit or miss, and there are other restaurants I like better. It's just so darn convenient.

I'm all set with Medicare and my Medigap plan, have my ID cards and am ready to go. But I was very disappointed to learn that Medicare does not cover standard physicals with the usual bloodwork. I like that extra level of reassurance that all is well each year. Medicare covers so-called "wellness visits," which mainly consist of cognition questions (!), a review of recommended vaccinations and going over your medical history.

In fact, no one told me about this, I just "realized" it on my own. So I had to scramble to to cancel a longstanding September physical and was able to squeeze it in this wee, this being the last month I have standard insurance. I'm getting the bloodwork for it done today.

One thing I want to do is find a new dentist. Since that's not covered by my traditional Medicare, I will pay out of pocket regardless, but the dentist in a neighboring town retired a year or more ago, and I'm not sure I want to continue with his successors. She gave me such a hard time about not wanting to do dental x-rays and said I would need to sign a "waiver," which seemed like scare tactics to me. It will be easier to find a dentist right here in town, anyway.

One interesting thing about my Medicare premiums is that they bill you on a quarterly basis. I just paid the first one. They let you pay for free with a credit card, so I figured I might as well get some rewards points for it.

I didn't think I'd ever need to worry abo

Posted in

Uncategorized

|

5 Comments »

June 19th, 2024 at 08:52 pm

Looks like most of the eastern half of the country is in the same boat. It was 99 when I got in my car mid-afternoon to go to the gym, wondering if I was crazy for wanting to stick to my schedule. Happy to report, they had the AC on (low), so I was able to complete my usual routine: about a half-hour on the machines and a half-hour on the treadmill.

My garage door opener started acting up recently and I had someone out here to fix it. He recommended a few more fixes to lengthen its lifespan, and he was supposed to return today, but was running very late due to the extreme heat, so we rescheduled for tomorrow morning.

Aside from my gym outing, I've been hunkering down indoors with the AC on at 76, which is really the warmest setting I can tolerate upstairs; downstairs, it feels comfortable. The shades are drawn on all the windows except the north side, and when I do leave the house, I've been exiting thru the basement and out through the garage to avoid letting a whole lot of hot air in through the front door.

I had also done some grocery shopping a day before the heat wave got going on Tuesday, so I am mostly all set with food. Soon, I'll have to go outside again to water my vegetable garden and potted plants. I hope they are not fried. I water them daily but the raised beds dry out very quickly. I'll also put out a second water bath for the birds and refill the feeder, which is hanging from a mulberry tree that's attracting lots of avian interest now that its berries are ripening.

So far, my veggie garden is pretty modest compared to previous years. I had been having a great "Yugoslavian Red Lettuce" harvest leading up to the heat wave, and then I began picking more assuming the heat would cause them to bolt. I have 2 cucumber plants and 2 yellow squash, but I planted them from seed in the wrong medium and so half of them are pretty anemic looking; the fertilizer I added later has helped. I also have 3 cherry tomato plants which are doing pretty well, and string beans only recently germinated. I was trying to avoid the overcrowding I usually have in the raised beds to the extent that I had trouble walking around in there. I hope I have some decent harvests nonetheless.

I took my father to his first physical therapy session. He's been there before (was it last year?) but more recently wrenched his lower back and was experiencing a lot of pain. Much of his problem stems from his very sedentary lifestyle, but he's getting on in years so I don't know how much you can reasonably expect someone like him to do. But he at least needs to do the exercises he does in therapy at home, when he's not there, and that's been an uphill battle. On top of that he only wants to go once a week, so I really don't know what progress we can make. Medicare approved it in an open-ended way, with no fixed number of visits, as long as both he and the trainer feel he's making progress.

Right now he's got a $15 co-pay for each session. He told me he wants to go to physical therapy once a week for the rest of his life, and is willing to pay out of pocket for it. So once he exhausts whatever number of sessions Mediare is willing to pay for, hopefully the PT place will allow him to continue on a pay as you go basis.

Posted in

Uncategorized

|

1 Comments »

June 17th, 2024 at 12:25 pm

What the hey. This site is just not monitored, and as a result is flooded with spammers, like the automotive manufacturing post.

I hope everyone had a good Father's Day, and hugs to those who cannot celebrate with their fathers. As I've gotten older, I realized how time with loved ones is fleeting. Most years now, there's a little dread associated with Mother's Day, and someday not in the distant future, Father's Day will feel the same way. Not to sound morbid, but it's one downside to getting older that no one ever warned me about.

I hadn't planned anything in advance with my father as I wasn't sure if he was spending time with his son or other daughter. This is how it goes in a family affected by divorce, remarriage and new families; it's hard to merge all together when you didn't really grow up together (and live in different states). At the same time, I didn't want Dad to be alone, so I did talk to him the day before to discover he had no plans. (His son had come up to see him a few days earlier.) So we went to a restaurant I didn't think would be busy because it's pretty much diner food, and I was right. The food was just okay, but we sat outside in perfect weather and enjoyed some good conversation.

On the way home, as I often do, I pulled over by a large pond (sometimes it's just some quiet wooded area or open space) and we continued talking in the parked car with the windows down. I often read things to him from my phone as Dad can't see well. He loves history, so I found a chronology of interesting articles about each of our American presidents, starting with George Washington. Yesterday we finished with Lincoln, so we are making our way through the list. We've been talking a lot about slavery, John Brown, Harriet Tubman.

I find that these seminal events and historical figures are much more meaningful to me when put in the context of my own family history. I've done a lot of genealogy work. My own great-grandparents were born around the same time as the American Civil War, all coming from poverty-stricken regions like the former East Germany, Northern Ireland and Galicia in Austria-Hungary, all coming to America in search of better economic opportunities. Just understanding that in the same timeframe, black people in America were still abused and treated as chattel, even after the war ended, what would otherwise seem like ancient history hard to fathom really comes alive.

It can be hard coming up with activities and experiences I can share with my father, given his physical disabilities. Eating out at a nice restaurant and going for drives are really the main ways we spend time together.

I had plans to join friends at a local vineyard for a casual, outdoor meetup with wine and good conversation this past weekend, but the woman organizing it cancelled it due to some predicted storminess. (It's been rescheduled in 2 weeks' time.) Instead, the 4 of us got together for dinner the following night, when the weather was again picture perfect. We met at a Nepalese restaurant I'd been to with my father twice. The food was great, the service excellent and prices reasonable. We will all meet up again at the vineyard with possibly more women from the online women's group we all came from.

Next weekend I'll be taking another friend out for a belated birthday breakfast.

I continue to be active with my 3 volunteer groups. Our next litter cleanup with the one group is in a shoreline town an hour-and-a-half drive from me, so I've decided to make a day of it and squeeze in one or two other activities/things to do on the drive home since the litter cleanups only take 2 hours.