My 2021 Expenses and Income

December 28th, 2021 at 10:19 pmTotal expenses for the year were $45,092. That's up a bit from last year's $41,000.

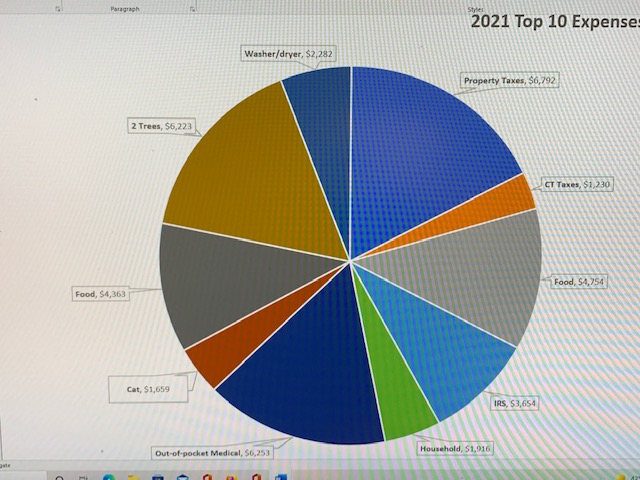

Top 10 Ranked Expenses:

1. Property taxes $6,792, about the same as last year.

2. Out of pocket medical: $6,253, which represented a huge increase from last year due to my menscus tear knee surgery and subsequent physical therapy.

3. Tree work: $6,223. I had one huge silver maple cabled and another huge white pine taken down, both for safety purposes.

4. Food: $4,363. This is notable as it is about $400 LESS than last year. (Each year, food just keeps on increasing, and this is the 1st time I've managed to spend less.)

5. IRS: $3,654, a new category this year since I'm self-employed now (still working for the same agency though) and so now I make quarterly estimated tax payments.

6. Washer/dryer: $2,282. This felt like a splurge but it really wasn't as I used an unexpected IRS refund. (Thank you, Joe B.) The purchase included cutting edge heat pump technology in the dryer, plus service warranties on both. I figured if either needed a repair it would be pricy.

7. Household: $1,916, a bit of a catch-all for stuff for the house.

8. Cat: $1,659. It adds up, between expensive cat food and vet visits.

9. State taxes: $1,230 (also due to my estimated tax payments throughout the year)

10. Lawn & garden: $1,193. This includes bi-weekly mowings.

Here's what my Top 10 look like in pie chart form:

What's perhaps more notable about my Top 10 list is what did NOT make it to the Top 10 this year: Health insurance, which last year cost me $3,524, substantially more than this year. (Again, thank you, Joe B.) Also of note is the fact that my property taxes and most utilities stayed the same: electricity, water and sewers. I did go a little crazy with clothing shopping, spending $721 more than last year. I spent $490 less on heating oil and $235 less on homeowners insurance (plus $237 less on my umbrella policy) after changing carriers. Another big drop was seen in my car upkeep: $700 less compared to last year.

Income-wise, I earned just a bit over what I spent, so I ended up with a net savings of $587 this year. This is fine as I stopped contributing to savings and retirement a number of years ago after I met my retirement savings goal. My strategy is to pay my living expenses with my part-time work until I completely retire in 3 years' time. So with my paycheck, combined with an Xmas check from dad and the IRS stimulus, I was able to cover 100% of my 2021 expenses. I even managed to earn $582 in credit card rewards and $446 in freelance work from my one remaining freelance client.

.

.