|

|

|

Viewing the 'Uncategorized' Category

March 26th, 2025 at 10:01 pm

Work with 2 of my volunteer groups is heating up, and these days, my rallies, demonstrations, phone calls and letter writing is very much another p/t job, so I guess you could say 3 of my volunteer groups are heating up.

I am very excited to have succeeded in building consensus between my environmental group and another nonprofit here in town that seeks to protect a certain river that is a sole source aquifer and supplies drinking water to half the population.

More recently, I joined a book club and the person who heads it up is none other than the chair of the river group. We got to talking about a certain thing we observed on the river that we both recognize is a problem. He was very excited about the possiblity of partnering with us to tackle it. I was ready to make a presentation to pitch the idea at our meeting this past week, but too many people could not make the meeting. Nonetheless, I got buy-in from 2 key people and finally got the go-ahead to invite the river man to come to our next meeting for further discussion.

In my 2nd volunteer group, I also scored a win by recruiting someone to act as our group's treasurer. We are desperate for board members; he's got a lot of good experience. Someone else may be bringing on 2 more new members whom we have yet to meet.

In the more immediate term, we have a beach litter cleanup this weekend, and then I organized another cleanup in another town for late April. I'm picking up more of the detail work that our former exec director did. I have to write a donor acknowledgement letter, and after that create a flyer to publicize the 2nd town cleanup on social media. A lot to do. I don't have a graphic design background, so that part of it has been a bit of a struggle.

Not much else new at the moment. Just trying to watch my spending and maintain my exercise and healthy diet habits.

Posted in

Uncategorized

|

4 Comments »

March 17th, 2025 at 04:55 pm

It's impossible to ignore everything that's happening in the world around us. I've become increasingly involved in local rallies, letter-writing and so on. I went to a rally yesterday in my hometown and listened to a series of heartfelt testimonials by local people. Included among them was the mother of a child killed in a school shooting here who somehow has the strength and determination to fight gun violence.

I did not expect that this is the turn my retirement would take. It often feels overwhelming, but I strive to do at least one small thing each day, and I'm trying to build a network with like-minded friends. Nearly every town around here has formed some sort of group that people can join. It's really heartwarming. I sometimes wonder how history will look at this period 10 years from now. I want to do my part, and be on the right side of history.

In other news...

My credit score has I believe risen a notch with my new car loan payments. It stands at 834 now, and I got the same message Dido did. He he.

I'm trying to avoid making purchases at Walmart, Amazon and Target. It hasn't been that hard.

Posted in

Uncategorized

|

4 Comments »

February 23rd, 2025 at 09:55 pm

I attended a wonderful democracy rally last night with a few friends. I'm so proud of my little hometown. The old gymnasium was packed to standing room only, and there was a very inspiring array of speakers, including representatives of the ACLU, local politicians, the local Indivisible chapter, and multiple other organizations fighting the felon. I think my favorite speaker was the pastor of our Congregational church. I was just impressed at his impassioned speech. Impressed because so often faith leaders retreat from political upheaval and play it safe by remaining "neutral." He was not. We also heard from a young Mexican immigrant who had already witnessed ICE arrests in nearby local city, some local high school students and a 97-year-old woman.

The snow and ice have finally begun to melt with warmer temps forecast all week before turning cold again. I took advantage by going out and doing some pruning: a fairly large branch of a Japanese maple growing straight into a mountain laurel, and a hard prune of bluebeard so it doesn't outgrow its space. Soon I am looking forward to cutting pussy willow branches to bring inside.

Now that I'm pretty much recovered from my cold, I did return to the gym for 2 days last week, but decided I would make Sundays my day of rest, and pull back the workouts from 4 days to 3 days a week. Since I was also going to the gym the other days of the week to use the treadmill, the whole schedule felt kind of demanding. Hopefully having Sundays "off" will make it feel more reasonable; it's not like I'm not going to do stuff so I will get some steps in anyways....

I am beginning to think more about various home improvements I want to do. There's always more than I can handle. I guess the first priority is repairing 2 small holes that were punched into my vinyl siding after storms. The 2nd one occurred just last week when ice on some old cable wires caused the wires to literally rip out of the side of the house. I didn't even know the wires were not needed when I upgraded to fiber last year, but they chose to leave them there. I have since had someone from the cable company come out and remove them, but now want to repair the holes to avoid insect or moisture infiltration.

I have actually been considering replacing my roof earlier than anticipated; it was last done in 2013 so it's just 12 years old. I would like to get metal roofing for over the garage and the front entry way and I would really like to get the guy who did it last time because he was honest and gave me a great price. I also have 2 exterior doors I'd like to replace plus a bigger fridge and would love to get an induction stove. And also redoing the stone stairs leading to the back yard. Obviously I'm not going to get all of that done this year; I tend to knock off the "easiest" projects first so who knows what will get done, and when.

Happy to say I have already gotten both state and federal tax refunds totalling about $3k.

Posted in

Uncategorized

|

3 Comments »

February 18th, 2025 at 09:31 pm

I decided this afternoon to go get some soymilk at Target as I was running low and this is a staple in my house. I usually get 4 half-gallons at a time so I don't have to go there so often. Hopped in the car, drove out there, parked and grabbed a cart.

If you've been to Target before, you probably know they have those nifty little compartments in the top front of the cart, perfectly sized for your cell phone. That's where I put mine as I headed down the long aisle to the refrigerated case.

I got what I needed, checked out and left the store, came home and did some reading, both online and off. At some point, I was on the computer and to log into a certain website, I needed to get the code from my phone. Except I couldn't find it. Anywhere.

I tried to locate it in the house with the Tile thing on my key chain, but nothing was beeping back to me.

It dawned on me that it was POSSIBLE I left it in the cart at Target. Oh no. Between my keys, my Faraday pouch that securely contains my car key plus my groceries, my hands were full and I am easily distracted. I called Target to see if anyone turned in the phone. The phone rang and rang and rang, and no one ever picked up.

Feeling desperate, I grabbed my coat and jumped in the car to go to Target. It's about a 15-minute ride to a neighboring town. About an hour had lapsed since I'd been to Target.

I began mentally to recall what was in my cell phone case: multiple credit cards, my driver's license and a small amount of cash. A lot of valuable stuff. As I drove, I was thinking it was POSSIBLE the cart could still be where I'd left it, up against a small island in the parking lot further away from the store since my car is still new and I don't want it dinged. So I've been walking further to any store I go to.

I pulled in to the Target parking lot and headed to the exact spot where I'd parked before. I saw the cart and pulled up as close as I could, but there were other vehicles on either side of it. MY PHONE WAS STILL IN THE CART. And all its contents.

I felt like doing a Hail Mary right then and there. Anyone who'd pulled up to park there could have grabbed the cart and found it, and may or may not have been honest, but I'm guessing with today's bitter cold, most people don't want to walk a freezing cold cart into the store when there are usually plenty already inside. The phone is in a brown faux leather case which has a pretty low profile and apparently was not seen laying in the front of cart. I am so relieved!!!! Also glad someone collecting carts did not find it, because from there, who knows....

I guess I'll have to go back to lugging a purse around.

Posted in

Uncategorized

|

6 Comments »

February 18th, 2025 at 05:07 pm

I'm about 95% recovered from the cold (or whatever I had), and I am running very low on certain food items, but strangely, I feel little motivation to go out now after being cooped up for 2 weeks. I did go out and knock most of the ice off my car but still have to work on the roof. I guess it's the cold weather...about 25 degree high today.

I feel like I've gotten NOTHING done, and I don't even feel like rushing back to the gym. I am usually very disciplined about doing stuff. I do plan to return to the gym sometime this week.

I did already get my IRS tax refund and am waiting for the state tax return to be processed.

I purchased a security key that I want to start using with all my financial accounts; hopefully I can set it up without too much trouble.

I spent $8 on a dozen eggs. I don't eat many, but like to have them.

Posted in

Uncategorized

|

2 Comments »

February 11th, 2025 at 05:47 pm

Thanks for all the well wishes on my last post. That night I was feeling a bit more energy, but waking up the following morning, I felt just as sick again. It reminded me I've always experienced this pattern of feeling sicker in the morning but better in the evening, and this worked in my favor as a child since my mother would see how I was doing in the morning before deciding whether or not to send me back to school.

But today I am definitely feeling more energy and have a load of clothes in the dryer. It was on my list of things I really want to do, along with my state tax return and shoveling my driveway. Doing the laundry is easier, so that's where I'm starting. Now I've gotten real ambitious and am laundering my bedsheets and duvet cover.

One thing I really appreciate when not feeling well....I can sign into my US Postal Service account and use Informed Delivery to see what mail will arrive/has arrived in my mailbox today to see whether I need to walk down the drive and collect it or not. I recognize the sound of the mail truck engine coming down my street so lazy me, I can check what mail he is leaving me WHILE he is leaving it.

I'd also like to walk down into the front yard and see if there's any sign of pussy willow catkins yet. Probably too early, but last year I was too late. They are very much an early spring arrival. I'd like to cut some to bring indoors, plus cutting them back helps keep them a reasonable size.

I see so many tracks in the snow. I know I have opposums and bobcat and not sure what else is roaming around. I keep a heated water bath for all. Last night's full moon illuminated the yard.

My plumber hasn't yet gotten the "sausage" anode rod he wants to use as replacement, if needed, in my heat pump hot water heater. He was here to do some annual maintenance but inspecting the anode rod was the one thing he couldn't do because I have very low ceiling clearance in the basement. Hard to pull the rod out from the top when you have just 6" or so. The "sausage" rod apparently fits in differently.

I like this plumber because he explains everything he's doing to me in great detail and will patiently answer my questions. I'm one of those people who tries to listen and learn as much as I can about what any contractor is doing. Knowledge is power and all that. He said most people don't care to hear it all, but I do. The more I know, the less likely some other contractor is going to rip me off, and believe me, many do, in different ways.

I also think his pricing is fair, and I like the discount they offer on furnace cleanings after the first one. He is from a local town, and his wife manages his scheduling via text. There are two plumbers in my town that have a lock on business, or so it seems. People on the town FB group recommend these two over and over again, almost to the point where you wonder if they are the only 2 plumbers in town. "Best in the business, hands down" and all that. I have hired both of them and found them lacking for different reasons.

Actually, there is another local plumber I discovered when a rusted-out pipe end cap burst in my basement last summer, whom I also liked. It's nice to have 2 plumbers in the mental Rolodex for any future plumbing issues.

Given the Felon-in-Chief's abrupt, autocratic, bull-in-a-china-shop style of decision-making about wide-ranging programs, I am feeling more nervous about my future Social Security income. My plan all along has been to wait another 3 or 4 years before collecting, but will it be there, intact? I had always reasoned in the past that if one Administration or another started making changes that I likely would be grandfathered in to existing rules given my age, but I'm feeling less certain of that now. If I felt changes were imminent, I would move to start collecting sooner, but would really rather wait.

Posted in

Uncategorized

|

4 Comments »

February 9th, 2025 at 07:14 pm

I've been sick with what I assume is a bad cold for nearly a week now. I've gotten vaccines for Covid, the flu, RSV and pnuemonia, but still I got sick! First time in many years.

It started out with at least 2 days of just a sore throat, which then progressed to a dry, hacking cough and fatigue. Now it's congestion and sneezing. Can't wait to shake this thing.

There was a point I was so tired I didn't even have the energy to read or watch TV, and I've already lost over 3 lbs. cus not much appetite and I was just eating the simplest things like toast, fruit and cheese. But I am dethawing wild salmon now for dinner.

Thank goodness a neighbor I don't often talk to texted me, I mentioned I was sick, she offered to get me anything I needed, and so I did ask her to get me cough medicine. I am more than halfway through that bottle already. Luckily, I'd done a big grocery shop right before I started feeling sick but those weights are going to feel extra heavy once I get back to the gym.

We had about 4" of snow last night but I'm not planning on shoveling, even though 2 more storms are headed here later this week.

In other news, I joined a Nature Book Club in town (we have 3 book clubs) so I'm reading a book about beavers now. The prior book, which was hard to get through, was about the high intelligence level (on a par with dogs and porpoises) of octopi.

I'm annoyed with myself because, well, I'm not used to driving a vehicle where you press the release latch on the back door to open it, and as I was feeling around for that latch, I inadvertently pushed inward (not that hard) on one of the license plate lights and detached it from where it was securely seated. So it's loose. Now I'm wondering how much $$ the dealer will want to fix that because the door is completely sealed in as far as I can see. Unless they have some sort of special tool.

I like the Toyota dashboard for my loan repayments, and I made the first of 2 big prepayments this past week. Still a ways to go...

Posted in

Uncategorized

|

5 Comments »

February 3rd, 2025 at 01:20 am

The tariffs imposed by our Idiot-in-Chief go into effect Tuesday in what he foresees as "America's Golden Age."

It could be more painful than that. Remember, rising prices won't likely be seen immediately, due to existing inventory, except for non-durable goods like food. We get an awful lot of food from Mexico. And I do worry about opportunistic and unethical price gouging by those seeking to take advantage.

I recently started thinking about stockpiling a few things like paper towels, toilet paper and the like. If I had a spare freezer, I'd fill it up, but since I really have very limited storage here, whatever buys I do now will likely have minimal impact on my spending in the months ahead.

My oil tank is still 3/4 full and should see me through most of the winter, but if tariffs remain in place through summer, it will definitely impact my usual dead-of-summer heating oil buy, when oil prices are usually lower. If I were an optimist, I might say this would all come to an end in 6 months' time, but who really knows. Still, I'm glad my car purchase is out of the way.

What about you?

In other news, I finished my taxes but am anxiously waiting to get the email from the IRS telling me my filing submission was accepted. In past years, I put zeroes in a few blank spaces that caused my return to be repeatedly rejected. It was a very frustrating process because the IRS does not precisely spell out what the problem was.

But anyway, despite having made about $5,000 more in income than I predicted and thus having to pay back about $500 to the Affordable Care Act, I should still wind up with a $1400 federal refund. At some point when my income becomes more consistent, I will tinker with taxes I have deducted, but right now it's still a bit of a moving target.

I'm eager to begin next on my state tax return but can't do that til the federal one is accepted.

Posted in

Uncategorized

|

15 Comments »

January 14th, 2025 at 02:34 pm

Recently, my 10-year-old Canon laser jet printer finally stopped working, and I had to buy a new printer. I paid more upfront for a laser printer, hoping to do better in the long run than spending increasingly ridiculous amounts of money (like $35) on those little ink cartridges.

I decided to just get a b/w printer. I don't use it often but do require it from time to time, for things like my upcoming tax return, which I do myself and so need to print out all the forms.

I got a Brother model that came highly recommended by a few review sites.

But oh, brother, what a hassle it was to connect it with my desktop computer. I had to call my Internet company (Frontier), and since I couldn't remember my rarely used PW for my WiFi, the rep said I'd have to change the password. That's really what started all my problems, because then my 3 Rokus no longer worked. It took a good part of yesterday afternoon to get this all sorted out. They decided to ship me a (free) Eero for the fiber, but even though we had finally fixed the problem on the phone, she said just keep it in case I have problems again.

Posted in

Uncategorized

|

3 Comments »

January 12th, 2025 at 06:37 pm

I was hoping to cool it on the spending spectrum after the car purchase, but alas, my 10-year-old printer is kind of kaput. I guess it was a good run. The rollers were just not feeding the paper in anymore, and after doing some research, there is a cheap little spring in there that often is the culprit and can't be replaced.

Since I wanted to print out my bank statement and then balance my checkbook, and tax season is right around the corner, I didn't want to delay too long, so after investigating whether I could insert a sponge, believe it or not, like one story I read, I just decided to spring (no pun intended) for a new one.

I rarely have need of color these days so I decided to go for a more economical black and white laser printer. Economical not in terms of upfront cost, which was about $200, but in terms of how many pages one toner cartridge wil print compared to an inkjet printer.

Although I hate Best Buy (horrendous customer service), Staples did not have the model in stock and I wanted it today, so that's where I went. I have not got it up and running yet and I absolutely hate having to do that sort of thing, but hopefully tonight.

I have many things I'd like to get done today but I know I won't get to most of them. Work out at the gym. Make lentil soup. Make date brownies. Hang the 2nd bird feeder. Winter pruning and invasive work in the yard since it's mild-ish today.

And now I'm feeling incredibly sleepy. Having green chai now.

I noticed the other day while driving that when I did a quasi-rapid acceleration, the chapstick thing I'd put in the little shelf in front of the stick shift flew out of there; I didn't really see where it went, but when I went to look for it, it was nowhere to be found. Could it be that the missing 2nd remote key to the car flew out of that little storage area in a similar fashion?

Again, for probably the 7th time I searched the floor of the car, front and back, and in between the seats in the center. I FOUND the chapstick but NOT the remote key. Dealer said it would cost $350 to replace and I'm still waiting to hear back what it would cost to install blind spot assist.

Posted in

Uncategorized

|

2 Comments »

January 10th, 2025 at 06:13 pm

2024 was the first year I tracked where I spent my grocery/food dollars. I generally try to minimize shopping at the more expensive stores like Stop & Shop, Big Y and Caraluzzi's, but these, unfortunately, are the closest to me. I like to stop at Whole Foods, Aldi's and Trader Joe's, but these stores are a good 15 or 20 minutes away.

I spent $4,717 on food in 2024.

Of that, I spent $1,200 at BJs. I let my membership drop this past fall. It takes so much time to shop there, and with the exception of the 3 or 4 lb bags of frozen berries, there's nothing I can't get somewhere else.

I spent $939 at Stop & Shop, which is like spending top dollar. I have to work on that, but it's convenient.

I spent $847 at Whole Foods, where I focus mostly on the 365 store brand, which is price-competitive.

Next, I spent $328 at Big Y, a regional supermarket that is priced about the same as Stop & Shop. Just a mile away.

Sadly, I only spent $292 at Trader Joe's, partly because shopping there is an absolute zoo with parking and other shoppers. It's a small store, always packed.

I spent $267 at Aldi's. We all know they have great prices, so I'd like to shop there more, but the challenge is they don't have a lot of what I need/like. I tend to shop only the fresh produce section and frozen vegetables there. That's it. Everything else is processed. While their parking lot is not quite as crazy as Trader Joe's, the traffic getting there is bad.

I also started shopping, to a lesser extent, at Target ($256), as they have a better price on soy milk, which I drink daily; it's on my way home from other places, too. I also shopped at Vitacost ($178) for a certain bread and cereal I like, at a local but expensive organic market which I think I will visit less often in 2025. I only spent $60 the whole year at Shop Rite(!) That's because they don't have great organic fresh produce, plus it's in a neighboring town (where my father lives) and it's just not somewhere I go regularly. This, too, should change.

Beyond that, I spent very small amounts under $100 at QVC, Amazon, Caraluzzi's, a local bakery, an Amish bake shop when visiting Dido, Harney & Sons, and even a local craft fair.

Conclusions: So I can perhaps whittle my overall grocery bill down a bit in 2025 (it's my #2 biggest expense) if I focus on these things, but if I end up spending more in gas to get there, it will defeat the purpose, so I will need to more carefully build in visits when I'm in the area.

I tend to make multiple trips to supermarkets each week. Why? Well, becus if I travel 20 minutes to Whole Foods or elsewhere and purchase frozen or refrigerated food items (especially in summer), then I know I won't want to stop in at other supermarkets for other items I want on the way home, leaving perishable groceries in the car. This happens often.

Posted in

Uncategorized

|

3 Comments »

January 10th, 2025 at 05:18 pm

I wrapped up my 2024 income and expenses a little late this year. I always glean little insights by doing this analysis after tracking my numers all year long.

1st Tier Expenses ($912-$7,194)

Let's look at what I call my 1st tier expenses. These are my 10 biggest expenses ranging from $912-$7,194.

Looking at the pie chart I created, I can quickly see that property taxes make up the lion's share, at $7,194; that's a nearly 4% increase from last year.

Next up is Food. I spent $4,717, a level that may have finally plateaued after years of steady increases.

My #3 largest expense is the catch-all category I call Household. It's where I put expenses that don't belong anywhere else. I spent $2,246 in this category, which generally includes things I buy for the house that aren't home improvements, like the $200 office chair.

My #4 biggest expense was Health Insurance ($2,231), which remained very low while I was still on Affordable Careh Act insurance, but once I got on Medicare mid-year, it did increase substantially.

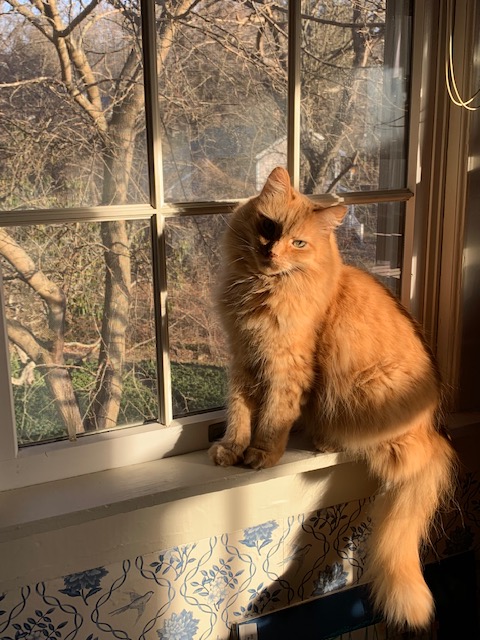

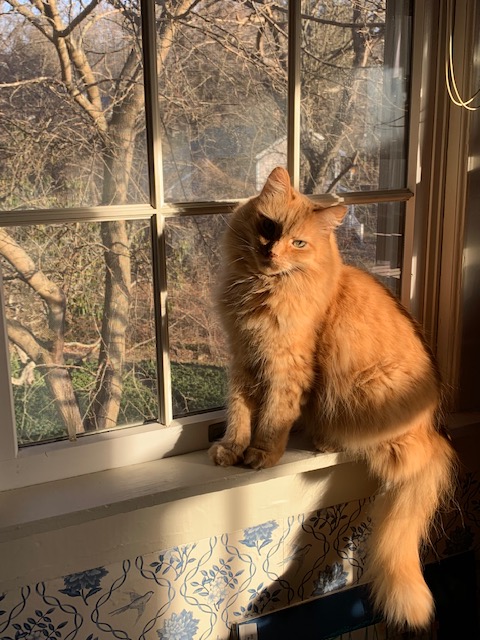

My remaining top 10 expenses included my cat, out-of-pocket medical and dental, electricity, lawn & garden, entertainment and heating oil.

So there were small 2-3% increases in some of these Top 10 expenses with the big jump in healthcare expenses, while electric costs and food stayed the same as last year. Surprisingly, my heating oil costs fell by 38%. I was expecting it to be higher since I'm spending a lot more time at home now that I'm retired, but I guess I'll chalk the drop up to market fluctuations.

2nd Tier Expenses ($511-$857)

In my 2nd tier expenses, I saw my homeowners insurance ($850) rise by 27.6%, a reflection of what's going on all over the country; my car insurance ($810) rose by 20%. No claims on either, ever. It's so important to shop regularly, if not every year, for both these insurances.

3rd Tier Expenses ($100-$500)

In my 3rd tier expenses (the smaller stuff representing 1.2% or less of my total budget), I saw my Internet cost rise by 19% due to a price hike which I fought unsuccessfully. My car repair expenses with my old Honda fell by 63% compared to the year before. (Side note: I'm glad I sold the car when I did. While it was running great and had nothing wrong with it, I think it would be due pretty soon for both new tires and a new battery.)

2025 Projections

For 2025, I expect to see my car insurance and car tax especially rise with the purchase of my new Toyota this month. (Side note: Surprisingly, I only had to pay $200 more to apply the same insurance coverage I had on my 11-year-old Honda to my 2024 Toyota. So that will see me through August, when a new, unknown premium will be due.) Health insurance and out-of-pocket medical expenses will also increase in 2025 as my first full year of being on Medicare.

I would LIKE to see my monthly electric costs drop as they had done for a while following the purchase of my heat pump water heater one year ago, but the utility company also raised its rates.

2024 seemed like a brutal year for rising prices everywhere, so it was nice to see a few categories where mine fell, not necessarily for the right reasons: A 12% drop in cat-related costs since he passed during 2024. A 62% drop in lawn & garden costs, simply because I didn't need to have any tree work done, so most of this expense was for lawn mowings. The aforementioned 38% drop in heating oil costs was nice to see, as was the 67% drop in maintenance costs (a random thing), the 32% drop in clothing purchases, the 26% drop in dining out and the 63% drop in car upkeep. There were a few other drops in other categories, but they are inconsequential.

My total expenses for the year were $41,645. That's $1206 less than last year, but I'm trying to get away from focusing on this since I am moving this year from the "save" mentality to the "spend and enjoy it" mentality.

Posted in

Uncategorized

|

9 Comments »

January 9th, 2025 at 06:02 pm

Yesterday I bought a new car.

I like it a lot. It's a 2024 Toyota Corolla Cross hybrid SUV. I almost didn't buy it because I was dealing with a salesperson who in my opinion was not a very good salesperson. I had started reaching out to several dealers via email on Saturday, just to get the ball rolling and to see what the prices were like. Two of the dealers just tried to get me to come to the dealership, which is what I was hoping to avoid, wasting time on multiple trips to showrooms. But the one most local to me was willing to negotiate price via email and we actually came to agree on a price that at least acording to Kellys Blue Book was a very good price, though when they say that, it doesn't include taxes, dealer fees or the price they give you on your trade-in.

Initially I wanted the 2025 model with SE (upgraded) trim, but they didn't have one of those on the lot, so if I really wanted it, I could buy from the factory but then I'd lose out on the dealer discount, which was about $1200. So when they told me they had a 2024 S model on the lot, which is the base model, I decided to go for that since I'd save some money buying a 2024 vs 2025, even though there were some add-ons to the car that I liked anyway.

So after agreeing on price, I did go in to the dealer to show them my car and get their offer on it as a trade-in. They gave me a very low price for it, which I anticipated, but he wasn't open to negotiation, so I walked out. I went home and did some quick searches for comparable models at other dealers and started talking to other dealers, but I concluded that the price was still cheaper at the first dealer, even with the lowball trade-in offer. So I called the salesman back later and told him I could come down $500 on the trade-in; so at that point we were just $500 apart. Then we agreed to meet in the middle and split the remaining difference.

I met with a separate person to go over the financing. I could have paid cash for it, as I've done before, but I don't want to artifically inflate my annual income that much, so would rather spread it out a bit over 2 years only. I got a 5 year loan but will begin prepayments immediately and plan to pay the whole thing off in 2 years. So instead of paying a little over $3,000 in interest alone, I will pay about $1,000 in interest.

I don't like the rate...6.98%... I was expecting something better with my "Exceptional" credit score, but those Toyotas sell themselves. I also decided to go with the "Bumper to Bumper" 10-year coverage plan where virtually anything that goes wrong with the car is covered except for maintenance things like oil changes and tire rotations (which are free for the 1st 3 years). Without the 10-year Bumper to Bumper coverage, you'd still get 3 years of free Bumper to Bumper coverage. But to get the full 10 years, it's $25/mth, which seems reasonable.

What I DIDN'T like is that they roll the cost of this coverage into what you're financing for the car. I'd much prefer to pay for it separately so I'm not paying interest on it, but that didn't seem to be an option. Just one more reason to pay it off quickly.

I am still learning all the electronics of the car. It's been 11 years since I bought a new car, so a lot has changed. I'm loving it so far.

The one fly in the ointment: I have already lost/misplaced the 2nd remote fob he gave me right before I left and was standing outside with him by the car. I've turned my place and the car upside down looking for it and am beside myself becus I know they are very expensive to replace should I lose the one that I have.

I have also asked the salesperson to find out for me how much it would cost to get the blind spot assist retroactively installed. (It would have been on the SE trim had I gone for that.) Becus going from a 4 door sedan to an SUV you lose a LOT of visiblity and it feels like all I can see through the rear window is what's directly behind me. I will have to use the side mirrors more, but still. I did also order some of those little mirrors to put on top of your side view mirrors that extends your blind spot range of view, but they are so small I'm not sure how useful they will be.

In other news, I went to pick up my father today for physical therapy, knowing he would be excited to ride in the new car since it will be much easier for him to get in and out of since it sits higher than my Civic sedan.

I had called him earlier this week to remind him that it's very cold outside and he will need to wear a proper winter coat. He agreed on the phone. At nearly 92, dad does not drive anymore, and of his 4 kids, he relies on me the most to take him out and do things, and I know he looks forward to getting out of his small apartment.

I went to pick him up this morning and he came walking down the stairs to meet me wearing a flannel shirt. I told him he needed to wear a real winter coat (he has a beautiful one my cousin bought him a few years ago which he has never worn). He said he wasn't cold. The wind was whipping the sides of the flannel shirt since he also never buttons his shirts or even zips the lightweight nylon jacket he likes to wear. He said he had trouble putting it on, which I think was an excuse since he knows I will help him put on his coat, as I always do.

Anyway, dad is the most stubborn person I know. Guess I inherited that trait. I left without taking him to PT, which I really felt bad about, but when it comes to his health and well-being, I put my foot down. (The only reason he got his covid shots was becaus he knew I wouldn't want to take him out without it.)

I think he just doesn't like being told what to do.

Knowing my father, who has zero negotiation/compromise/flexibility skills, this standoff could last til more temperate weather in spring. I'm not sure I can last that long because I don't like doing things that distress my father.

Posted in

Uncategorized

|

5 Comments »

November 8th, 2024 at 01:38 pm

Since SA never bothered to inform us, in case you didn't know:

Type: Breach

Source: Mother of All Breaches (MOAB): savingadvice.com (62,583 Records)

On January 22, 2024, a large collection of previously breached data known as the 'Mother of All Breaches' (MOAB) was leaked online. Compromised data from savingadvice.com was included in the collection. ZeroFox extracted 62,583 records containing personally identifiable information from the data.

What should I do?

- We recommend you log into and change the password to any accounts where you use this email address to log in. Furthermore, be aware of any suspicious emails asking for your personal information as they may be phishing attempts designed to fool you into providing sensitive information to malicious websites.

Posted in

Uncategorized

|

3 Comments »

November 5th, 2024 at 02:35 pm

I have never felt the need to enroll in EZ Pass for NY-area bridges or toll roads because my travels into New Jersey, New York or points west are fairly infrequent.

However, I did make 2 trips to PA in the past 2 months, plus a trip to Jersey, so I knew to expect mailed bills for the Tappan Zee Bridge toll. I finally got the paper bill yesterday, and they were charging me a late fee for not paying an earlier bill that I never received.

I just decided to pay the whole thing (grand total $20.09) to avoid the hassles as I've had problems paying EZ Pass bills before, whether by phone, online or paper. In fact, I once received a rather ominous bill with hefty late payment penalties from a law firm doing collections for EZ Pass for a bill I had indeed paid! Thank goodness I saved the payment receipt, so I mailed them a copy and I never heard from them again.

On the paper bill, it said I could convert to EZ Pass NY and save $12.19 on the bill, yet when I called to pay the bill, the recording said I would save only .50. (I later realized I couldn't get the EZ Pass now because I plan to buy a new vehicle early next year, and EZ Pass would be registered to my current vehicle.)

The automated phone voice also said my balance was $2 higher than the paper bill. WTF? I just got the paper bill yesterday and it said I have until Nov. 27 to pay it. Multiple discrepancies.

And finally, when I tried to pay over the phone anyway, it rejected 2 different credit cards that I know to work fine.

When I called customer service, she said their system was down. Which might explain why my attempted payments were rejected.

I will call customer services again tomorrow to see if their system has been fixed. The person I spoke to today let slip that she couldn't erase the $5 late charge because their system was down, so I will ask them to do that tomorrow, and then pay the balance over the phone with the rep, but I'm super nervous about paying without getting a receipt due to all the mistakes they make. And then I will open an EZ Pass account after I get a new vehicle next year.

Posted in

Uncategorized

|

4 Comments »

November 2nd, 2024 at 07:26 pm

Yet another data breach compromising my personal info, except that this time I don't even recognize the name of the company that apparently had my info: Change Healthcare. Yet another data breach compromising my personal info, except that this time I don't even recognize the name of the company that apparently had my info: Change Healthcare.

I will call them Monday to find out who this is and what my relationship with them is. As is par for the course, all they can offer is free credit monitoring.

My new dentist came through with a $52 refund in the mail. I am now officially a senior, and they are the first dentist to offer a 10% discount to seniors, but I hadn't gotten it when I was there. I was also quoted lower prices for their services over the phone than what I was charged when I was there, becus they recently raised their prices. Good thing I keep notes. So that's what the refund is for; they volunteered to honor the prices I was given over the phone. The original bill (assuming a full set of x-rays and without the senior discount), was $280.

The reason I had left my last dentist is becus 1) they are a further drive, and the only reason I was going to them is becus they bought my regular dentist's practice when he retired, 2) but also because I didn't like their aggressiveness in pushing me for x-rays all the time.

My new dentist did the same thing, but we finally agreed on a set of 2 bitewings, or 4 x-rays all together. Instead of the full set of 21!! I am not a believer in getting annual routine x-rays when there is no discernble problem. X-rays have never revealed any problem in all the years I've seen a dentist, ie, all my life. At most, they look at them for about 30 seconds before consigning them to a file somewhere.

Radiation is cumulative, after all. She wants to do them every 2 years, more than I would like, so it's either fight those battles, which can be unpleasant, or try to find a dentist who doesn't push so hard. I mean, it is my body after all. I get really tired of the same argument from them and I suspect their insistence comes as much from a financial motive as a real concern for my dental well-being.

They did compliment me on my teeth (which others have done), and this totally surprises me since I have a lot of fillings from my childhood and I never wore braces. But I do take care of them. In fact, the dental hygienist, after looking at my teeth, said Oh, you know what you're doing...

I wasn't crazy about the hygeinist though. She just seemed a little heavy-handed. She was older and had plenty of experience, but I prefer someone who's more careful introducing tools to my mouth and so on.

I still remember years ago my mother telling me how extremely painful it was when she had to have scaling (cleaning below the gumline) was. After that, she was absolutely fastidious about her teeth becus she didn't want to repeat that experience. And neither do I.

In other news, I've already begun my holiday gift shopping and am well on my way. I pretty much know what I want to get for everyone except my cousin, the man who has everything. Having visiting him last month, I could see for myself the many, many boxes of unopened items he'd purchased online and never opened...terrible! How wasteful! Lately, at a loss for what to get him but feeling obligated becus he gets me very, very nice presents, i wind up shipping food to him from Omaha Steaks or similar companies.

I need to have my other cousin's gift all buttoned up by Thanksgiving since we've gotten into the habit of meeting for Thanksgiving at a restaurant in Westchester, and that's when we give each other our presents (not to be opened til later) to save on shipping.

My father complains each time I buy him something, saying I shouldn't have and otherwise undermining the joy I derive from giving something nice to a person I care about. That is why, ever since my mother passed, I like to buy little things for others. I would also like to make charitable gifting more of a regular thing, but I'm unsure how much I should put aside for this or what i can "afford." There are so many wonderful, deserving causes. There was a time I was donating $100 a month to a different group each month, and I enjoyed researching new-to-me groups as potential future recipients.

Two chickens have been hanging out in my yard the last few days. I posted their pictures on my town's facebook page and I was urged to call the animal control office asap so they could come catch them. Umm, don't think so. Then a woman way across town was hoping they were the chickens they lost and she came over, 3 little kids in tow, expecting they could catch them, but the kids, maybe 5 years old at most, seemed more interested in kicking my plastic watering can around and playing in the bird bath. I am more interested at this point in finding someone who can get them and add to their own flock more than I am in finding their rightful owners, but no one else has stepped forward and I'm afraid predators will get them any day. The last I saw them was yesterday, when the children frightened them and they kept their distance.

Another rite of passage: I got my one-time pneuomonia shot last week. It hurt a little more than other vaccines I'd gotten, and that was not my imagination. The nurse said the viscosity of Pneumococcal shots needs to be thicker, for whatever reason. Still, the more I read, the more of a supporter I am of vaccines in general.

Posted in

Uncategorized

|

2 Comments »

October 27th, 2024 at 10:44 pm

Today I noticed a post on my local town FB feed from a woman looking for donations of toiletries and other items to me put into gift baskets, a fundraiser for our regional hospice. I reached out to her and offered her 7 small pieces of my mother's work, which she said they'd be happy to have.

I packaged them up carefully and put them out in my Buy Nothing bin for her to pick up. I thought perhaps I was "over" this happening, but as I cleaned and then packed each item, I felt a melancholy come over me which has stuck with me all day.

It just makes me miss my mother.

I also gifted a few other items so I felt good about decluttering ahead of a possible move in a year or two (or three, if the real estate market doesn't open up).

I also made it to the gym and changed the bedsheets. With Luther not around, I am enjoying the luxury of having nice blankets and throws on the bed, something I didn't dare do when I had cats. Tonight after changing the sheets, I decided to bring out a throw that my mother made probably 60 years ago. I always liked it. The last time I had it out was about 15 years ago when I did a photo shoot with Waldo. But just having that blanket out, much as I enjoy looking at it, also stirs up emotional stuff.

Tomorrow's a shopping trip with planned excursions to Trader Joe's and Whole Foods after I get my first ever pneumonia shot.

So my father and I are back from a 3 day trip to visit our cousin. On the drive down, I got off on an exit where they indicated that restaurants and gas was available to either the left or right. Well, I chose left, then drove for many miles without seeing a single restaurant or gas station. We finally wound up in Shenandoah, PA, where we had a not very good lunch at a pizza joint, but the scenery was probably the best we saw on the whole trip. I was feeling "lost" at the time so I didn't stop to take pictures.

My cousin's grandson and grandson's girlfriend are also living in the house. We didn't really do much but we did have a nice dinner out at the Great American Saloon (great food, lots of taxidermy) and then breakfast out on the morning that we left. It was a loooong drive but really just consisted of 3 interstates and then a local highway. I think it took about 5 hours. Both coming and going, we stopped in Milford, PA where Dido and I have met a few times. Going down, I used the rest room and picked up drinks for us at the Wren Cafe, and on the way back, we had a pretty good lunch at the Apple Valley Restaurant.

Posted in

Uncategorized

|

2 Comments »

October 20th, 2024 at 02:13 pm

So, wow.

On my to-do list was double-checking that my current Part D drug plan, Wellcare, was still a good choice for me in 2025 given that I learned Wellcare will no longer work with Boomer Benefits, the insurance agency that helped me sign up for Medicare.

The huge advantage that Boomer Benefits offers (you can find their very active Facebook page) is that unlike most any other agency, they readily intercede on your behalf should you have a billing issue or some other matter that requires contacting the insurer. I felt this was such a valuable benefit that I decided to enroll in a traditional Medicare plan that was slightly higher cost than the lowest cost plan, solely because the lowest cost plan one did not work with Boomer Benefits.

So since I had to go on the Medicare site to pay my quarterly premium (which comes out to $174 a month, or $525 a quarter), I checked Part D/prescription drug plans for 2025. Turns out my current (Wellcare) drug provider is the cheapest plan based on monthly premium costs + deductible. This year, my monthly premium has been .50; next year, it will be $12.40.

What also makes a big difference, aside from which pIan/provider you choose, is what pharmacy you fill your prescriptions at. I do take one generic drug intermittently on as as-needed basis, which so far has been every other month, and lately I've been relying on Stop & Shop Pharmacy. Based on that rate of frequency, I will never reach the point of paying the $590 annual deductible in full, BUT IF I DID, then CVS or Walgreens would be cheaper than Stop & Shop.

Just by way of example, my lowest annual cost for this one generic drug (on my current plan) is $172, but the same drug/dosage cost $532 on a different plan. Not to mention a big difference in prices between a "Preferred" pharmacy and an "In Network" pharmacy. In the past I never bothered comparing prices between pharmacies. It just seemed like too much of a hassle, but now, with Medicare's convenient pricing tool, you can compare drug costs at up to 5 different pharmacies in your area quite easily.

So it's really important EACH YEAR during open enrollment time to review whatever meds you're on and compare costs on the Medicare site. This is something I wasn't accustomed to doing when I was on either Obamacare or a private employer-sponsored plan where you had no such choices. So I'm beginning to appreciate what Medicare can do for me. It's easy enough to do, though if someone had multiple medications, I can see how things could become more complex.

I've also never tried using my yellow RX card, so maybe next time I have to fill a prescription, I will first try using it to compare costs.

Posted in

Uncategorized

|

5 Comments »

October 18th, 2024 at 02:52 pm

I finally received my IRA CD distribution in the mail this week; it took over 4 weeks to get, which I think is unacceptable. I did file a complaint with the OCC; perhaps that sped things up a bit. Now they're sending me surveys asking me if I'm happy with their service. Unreal.

I had them deduct state and federal taxes, so my net was just about $9500; still, I plan to live on that, and 2 more monthly annuity payments, to see me through the rest of the year. So glad to finally have this behind me.

I've been waiting for someone who was to show up today between 8 and 9 am to look around and provide a price on mouse exclusion. They appear to be a no-show. It's very disappointing how many service providers like this can't seem to meet even minimal requirements for doing business, like showing up.

I got one price already but at $2600 it seems pretty high to me for what they do: putting up a barrier all around the house under the lowermost level of vinyl siding. If I ever wanted to upgrade my siding, it would all be ripped out and a waste of money. I'm not planning on doing that, but still... It bothers me that after spending $2600 they won't guarantee their work unless you also subscribe to their monthly trapping program, which tells me they know that the exclusion alone won't work. Hence my hesitation.

I brought my father to Walgreens after scheduling appointments for both of us to get our flu shots (we already got covid shots, and my pneumonia shot is in another 2 weeks), but I was unable to get mine because I forgot to bring my Medicare card. I was following sensible advice about not always carrying it around, in case you lose your wallet. I've rescheduled my flu shot for this afternoon.

We still waited 50 minutes for him to get his shot because someone had not entered my father's middle initial correctly in their system, and it needed to be a perfect match. Then the home address didn't match up becus my father insisted for years on using his son's address in NJ as his home address. I won't even go into why. So Walgreen's was asking me to confirm the exact home address in NJ, and since my father has trouble standing and walking, I didn't want to make him get up and walk to the counter, and he is hard of hearing, so I was yelling at him dad, I need the exact address and so on in front of other customers. Then he was confusing his current address here in CT with the old one in NJ. Nothing is ever easy.

I'm avoiding going to CVS now because when we were there for our covid shots, they charged my shot to an old insurance provider, even though I gave the guy behind the counter my Medicare card. I only know they charged it to the old provider because I got automated text messages from CVS saying thanks for choosing XXX. I've been waiting to get a denial notice from them, but so far, nothing. Maybe they won't bother? Seems like it will be a hassle to get that straightened out. Sigh.

Today I have nothing specific on my agenda except the flu shot this afternoon, working out at the gym and cleaning up up some tree limbs I cut down 2 days ago. Hoping it will be a stress-free day.

I planted a lot of small trees when I bought this place 30 years ago, and now they've all gotten pretty big. The tree I'm working on taking down now blocked my view of the front yard and also was growing into the fence surrounding my raised vegetable beds, so I decided it should go. Maybe it will help my lawnmower from gouging the lawn in this particular area when the tree is gone.

Posted in

Uncategorized

|

2 Comments »

October 11th, 2024 at 02:42 pm

As of right now, I still don't have the IRA CD distribution I requested from US Bank on the date that CD matured on Sept 12.

After 6 painfully protracted phone calls (with 6 different individuls, of course) and 3 separate trips to the library to fax them their 3 required forms, I finally filed a complaint that was confirmed by the OCC (Office of the Controller of the Currency), which regulates US Bank.

So this morning after noting the passage of another week, I called US Bank to check on status, and they told me the check was mailed out Oct. 7 so I should have it any day now. I almost couldn't believe my ears and asked the rep to repeat what he said. Interestingly, the email confirmation of my complaint by OCC was on Oct. 7, so I am thinking that complaint really moved the needle on what has become a horrendous customer experience with an inept bank.

I can't wait to ditch my credit cards with them, but want to wait til I deposit the check.

Posted in

Uncategorized

|

1 Comments »

October 7th, 2024 at 10:07 pm

I had my mason over here a few days ago to repair a crack in my foundation. He had told me earlier it would cost "a couple hundred." I'd been trying all summer to get him over here, but I knew it was a small job and that he'd probably rather focus on the big jobs first.

I was just about ready to move on to someone else but he finally came through, sending his father, who is part of his crew, to do it.

I texted the mason later that day and asked him what I owed him. He said "No charge!" since I've referred him to others many, many times. Yay!

That's helpful, since I have just $1300 left in checking and no idea when I'll get my CD from US Bank that matured Sept. 12. . I am so aggravated with them that I filed a complaint with the OCC (Office of the Controller of the Currency) as they are the ones that regulate this bank.

Posted in

Uncategorized

|

3 Comments »

October 6th, 2024 at 03:05 pm

Plenty to do today, but I'm procrastinating a bit.

It's been a while since I've posted pix of my gardens, so thought you'd enjoy seeing what's in bloom here now.

This is a low-growing wood aster.

These are Autumn Joy Sedum with mums (not daisies).

This is a buttonbush I planted last spring. It's a small, native shrub that gets beautiful pure white gumdrop-looking flowers in summer that turn into these seed pods later in the season that feed wildlife.

These are snowball hydrangea flowers that start out pure white in late summer and gradually turn a bronze-pink color. It was once a small tree but it was toppled by a storm years ago and now it's more of a multi-stemmed shrub, as vigorous as ever.

These are hyssop in the back, a total bee magnet, and cosmos in front, which will bloom from early summer til frost. Such an easy, carefree flower.

This is white snakeroot and sneezeweed. I love the late-season color when many other plants are spent.

More wood aster, such an important native fall pollinator plant that grows freely around here with several different species.

My main Autumn Joy bed, photo taken in mid-September. The flowers gradually darken.

This is blue mist flower, a native that popped up in my veggie raised bed, which I then transplanted to a more suitable spot. It has already spread a bit in just one year.

This is bluebeard. Not a native (it was mislabeled by the grower) but gorgeous nonetheless and popular with the local native bees.

Milkweed seed pods

Sneezeweed with bumblebee closeup.

Tatarian aster is not native here in the Northeast, but....It gets to be about 6 feet high unless you remember to cut it by a third mid-summer.

Posted in

Uncategorized

|

3 Comments »

October 2nd, 2024 at 08:53 pm

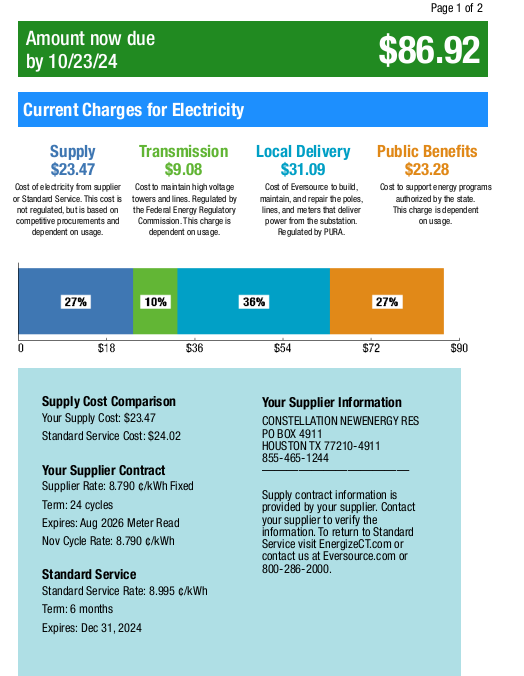

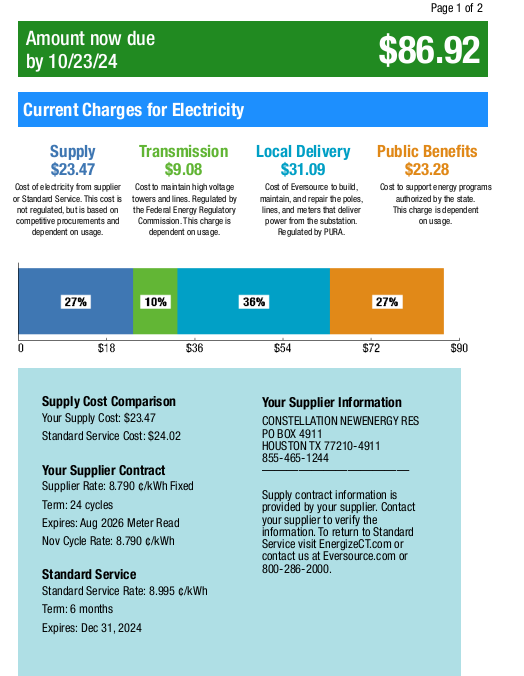

Here's my most recent bill. People all over the state are up in arms right now because the Public Benefits charge, which allowed people to not pay their bills during covid, shot up. It also covers the cost of new EV stations? I believe these higher charges for the rest of us will last for 10 months. People are furious.

Anyone in my state would think this bill is great. I have seen people in my town's FB page post bills of $900 for a month! But then upon closer inquiry, you learn they have a heated swimming pool or Jacuzzi.

Posted in

Uncategorized

|

3 Comments »

October 2nd, 2024 at 02:34 pm

I still don't have my $12k from an IRA CD that matured on Sept 12. I'm down to about $400 in my checking account.

Had another stressful conversation on the phone with them just now. Two weeks ago, they promised to "expedite" the distribution, but here I am, still waiting for their snail mail check to arrive because banks don't operate in the 21st century. Apparently they don't believe in direct deposit of funds (they consider that a transfer, not a distribution), nor even email to send me forms to fill out; had to make 2 separate trips to library so as to use their fax machine to return said completed forms to them.

Today's rep sounded competent, so fingers crossed...but so did the last rep. She emailed her supervisor, her supervisor's supervisor and a few other people to expedite it a 2nd time. She said she saw it had been "disbursed" but not "redeemed" or "processed." This is bank code for let's slow down this process for as long as possible.

The customer service manager is supposed to call me today by 1:30 pm and a cashier's check may be overnighted tonight. The key word being "may." They acknowledged this was a banking error and said it was a "coaching opportunity" for them. However, I have a doctor's appointment scheduled for tomorrow morning, and it being less than 24 hours from then it is too late to cancel it without being charged. The bank will probably want me here to sign for it, so I don't know. Maybe they can have it delivered in the afternoon.

It's really messed up my cash flow. I know I can take an IRA distribution from other sources but prefer not to do that for various reasons. And becus I am stubborn. Banks can accept your money in about a half-hour when you purchase a CD, but getting it back should not take a month and all this aggravation.

Will they be paying me the interest for the additional weeks they've held onto my money? I don't think so. So they are making out financially by dragging their feet.

Last night I finally heard from my mason; I've been asking him all summer to repair the crack in my foundation, but it's a small job, so I think he kept putting it off in favor of higher paying jobs. Now he wants to do it this weekend, which is great, but it will be a couple hundred dollars, putting me perilously close to zero in my checking account.

But wait! I forgot that since we're now in a new month, my monthly annuity payment should show up in my checking account by tomorrow. The annuity saves the day!

Regardless of that, I will be cancelling my US Bank credit cards and will never do business with them again. Even though that will surely zing my very high credit score because between the 2 cards, my credit card limit with them is over $20K.

Or maybe what I'll do is apply for a new credit card with an upfront bonus of $200 or $250. Once that card has been secured, I will cancel just one of the US Bank cards and see how that impacts my credit score. If it's not too bad, I will cancel the other one in short order. No use shooting myself in the foot.

Posted in

Uncategorized

|

2 Comments »

September 21st, 2024 at 12:50 am

I had an IRA bank CD maturing Sept. 12. What a pain in the butt trying to get a distribution. They make it so easy to open one, but gosh, seems like they try to put up as many roadblocks as possible to prevent you from accessing your money.

They wouldn't accept a phone call from me a few days ahead of that as to what I wanted to do with the CD; they said I had to wait til the day of maturity and then i had just 10 days to let them know what I wanted, or it would renew again for another 5 years at 2.something%. Nope, nope, nope.

The US Bank rep insisted that if I wanted it transferred to my bank checking account, that they wouldn't consider that a distribution, and that if I wanted a distribution, they'd have to mail me a check. Yes, snail mail.

I filled out all their paperwork and was told I had to fax it to them. Not email. Special trip to the library to do so. The following week, they send me a snail mail letter saying I failed to complete their transfer form and they were returning my application to get the distribution. Which they hadn't included with the other forms they sent me to complete and return. In the letter they said to complete and return the form in the enclosed postage-free envelope. Except there was nothing else in the letter!

So I had to call them again, and that was when I learned they don't consider a transfer to my bank a distribution. Egads.

They promised to expedite my case once I resent the original paperwork (another trip to the library fax machine) and handwrote in, "Mail me a check." Meanwhile, I have just about $1600 left in my checking to cover the bills.

Much of this back and forth could have been avoided if their forms were clearer. But I know from having worked for a large bank for a few years that banks seem to want to minimize the information they provide to customers, about anything. They are very secretive. I used to work in customer communications, writing a wide variety of letters to customers about all sorts of things. They were always less than transparent. Hated that whole vibe.

Yesterday was an extremely busy today. In addition to battling with US Bank, I also struggled to assemble two kitchen dining chairs I bought from Bed Bath & Beyond. There really wasn't much assembly, but I got stuck with this square metal piece that is supposed to let you swivel in the seat. You couldn't screw a screw in the 4 oval holes in the metal plate and i just couldn't figure out how I was supposed to attach it to the chair. The assembly instructions consisted of only diagrams, no words.

Every time I communicated with BB&B, I'd have to wait a day for a different rep to email me back and they seemed unable to let me talk to a technician would could walk me through it on the phone. They said I could return the chairs for a refund or find a handyman to put the chairs together. I FINALLY figured out by myself that the square metal piece could be pulled/pried apart/rotated, revealing an additional 4 holes and another metal plate that you're meant to attach it to the chair with.

I got in a 35-minute walk with my weighted belt, reorganized my dining linens (tablespreads, placemats, runners) and was able to gift some and donate others to good will. Now what I had left (mostly my mother's things) could neatly fit in the storage bench.

Also yesterday I was interviewed over the phone by a news reporter about knotweed, the focus of one of the group's I volunteer with. She had a very tight deadline, and by the time I called her, she only had 2 hours, but we spoke at length and today I saw the story published online. What's great is that Hearst News owns not just one daily in my state, but a whole bunch, so the story appeared in every one, plus a bunch of weeklies and a monthly magazine and various online news outlets to boot.

So in one feel swoop my group just got a whole lot of exposure. I shared the links with the other board members and everyone is thrilled. It really gives us a lot of "cred," and being a relatively new group, this recognition is very helpful. Finally, yesterday, I somehow managed to wash 3 windows here, inside and out, as I had noticed a while back how dirty they looked. I also washed the trunk liner in my car, ahead of my planned trip to visit DIDO next week!

I am very much looking forward to this trip (rain or no rain) as I haven't done anything like this (mainly, becus of my cat) for a very long time. It will be refreshing to have the change of scenery. We're about 2.5 hours apart.

This am I went driving around with another board member of the knotweed group. We were looking for homes that have knotweed and making a list of their addresses. We plan to write and then mail a simple brochure asking people, Do you have knotweed, then explaining how to ID it, why it's bad and what they can do. It's a unique plant in that it's not easy to kill, and all the usual methods, like cutting it, mowing it or digging it out will actually make it spread worse. It has to be treated with herbicides. Preferably by a licensed applicator.

We are a small group of local residents, so all we can do is raise awareness and educate people (both homeowners as well as public works employees) about management best practices.

I worked out at the gym in the afternoon, but otherwise, that's about all I did.

I'm supposed to do a litter cleanup at a beautiful beach/preserve tomorrow am but it's over an hour away and they want everyone there by 9 am. Which is feeling more and more doubtful.

Posted in

Uncategorized

|

12 Comments »

September 12th, 2024 at 11:09 pm

It's hard to say goodbye after 17 years.

Even if you knew it was coming.

I took him to my old vet, not the new one, because I remembered how good he had been with Waldo at the end, 8 years ago. The staff were caring. Luther did not seem overly frightened from the car ride or the barking dogs as we awaited his sad fate together. There was a small window that looked out on the parking lot, and beyond that, a bit of woods, and together we looked out that window for quite some time, given some privacy before the end.

Not much more can be said right now, except my heart feels like it's been ripped out.

He was a good boy, and he had a good run.

Posted in

Uncategorized

|

11 Comments »

August 31st, 2024 at 09:42 pm

I spent a wonderfully productive couple of hours this afternoon organizing my kitchen to be more attractive to a prospective home buyer. Suddenly, a layout that worked for 30 years seemed cluttered and unattractive.

I only made a few little tweaks, but what a difference. Remembering how positively meticulous and clean the homes at every open house I've attended looked, that boxy oversized toaster oven that was my mother's, stuck in a corner next to the stove, was too much. I mainly use it to bake salmon, but decided I can do that in a frying pan, stovetop. Once in a great while I roast garlic in it. I liked using it because it used less energy than my full size electric stove, but it's been a few years since I used it to cook raw oats for my homemade granola or toast nuts and I cook sweet potatoes in the microwave, I have less and less use for it. And I really don't eat much toasted bread.

I cleaned it up as best I could and offered it on Buy Nothing and had a quick request for it. Done! The cute set of 4 Pottery Barn ceramic pumpkin plates that I got myself on Buy Nothing but never really used, I decided to offer on Buy Nothing and got about 10 people vying for them. Perfect timing and great for kids.

The other big appliance taking up counter space was my microwave. It's a smaller size, and believe me, smaller than the one I used to have, but still, not especially attractive on the counter. I have a large kitchen cabinet which curiously has an electrical outlet on the back wall inside it; there must've been a remodel at some point. Anyway, my fairly compact microwave fits in there perfectly, and voila! I don't have to look at it on the counter. And with some further organizing, I was able to fit all my food items back in this cabinet, which I remember the listing agent laughably called a "pantry." I composted an ancient jar of corn starch, a smaller jar of garlic powder that expired a year ago and set aside an unopened jar of fake maple syrup for my friend's mother.

This was just a spontaneous thing I started doing when I got home from a gym workout. I really like tackling little corners or rooms of the house like this...so it doesn't seem so overwhelming when the time gets near to list it.

In other news, I ordered a navy blue , la t-shirt off Amazon that i planned on wearing while marching in the parade Monday, but I somehow ordered a men's size x lg and it's way too big on me; they don't want the return but refunded me for the purchase, so I plan on bringing it with me and offering it to someone else in our group who may want to wear it for the parade and then just keep it.

I'm down to just $1,000 ($1900 as of Sept 2 after monthly annuity payment), which has to last me til my CD matures Sept. 12. I'm not expecting any more big credit card bills, so I should be okay. That CD is $12K, and I plan to make that cover all my income needs for the remaining 4 months of the year, along with my annuity. So that's about $4k a month, doable.

Posted in

Uncategorized

|

5 Comments »

August 18th, 2024 at 11:36 pm

We had torrential rain all day today and now, half the roads in town (including the interstate and other state highways) are closed or washed out. The meandering river that flows through the heart of town is now a force to be reckoned with; I do believe one storefront may have to be torn down as the water overflowed the river banks and the structure, as seen from drone footage someone took, appears now to be IN the river.

I'm seeing cars floating in what was the road, abandoned by their drivers. People on our local FB page opening up their homes to others who can't make it home. They have declared a state of emergency.

I am counting myself extremely fortunate as last I checked my basement remains dry. I attribute that largely to the fact that when I had my back paver patio rebuilt, I knew the grading was bad and specifically asked my mason to slightly tilt the pavers, which run the length of the house, away from the house as much as possible instead of making it level. This turned out to be very effective in keeping water from accumulating near the foundation, and instead it funnels it all down to some old stairs i have which lead to my driveway, and there is a downward slope to the drive, so the water all eventually runs toward the street and storm drains installed there.

Feeling stir crazy, I had actually really wanted to go to my gym, which is just a few miles away, but I'm glad I didn't as they did close that road as well. The sirens have been nonstop since mid-afternoon.

I'm going to cancel an appointment I had Tuesday morning as it may take a while for these waters to recede.

Posted in

Uncategorized

|

3 Comments »

August 12th, 2024 at 01:12 am

Well, this is entirely not money-related, but I do feel a great sense of accomplishment/satisfaction since I was able to basal bark treat 4 small tree of heaven saplings. Tree of heaven is one of just 2 plants i can think of that absolutely must be treated with an herbicide to eradicate. I learned this the hard way; each time I cut it down, it not only came back, but several more sprung up in the vicinity.

So that makes a total of 10 tree of heaven saplings I've been able to treat this summer. I have until early October to do as many more as I can. The real challenge is beating a path to each sapling, which are growing in heavily brushy areas I usually avoid this time of year due to ticks.

I'm not sure how many more I have....at least a few...plus the big tree that needs to have the "hack and squirt" method used. Then you wait 30 days, then cut down only when completely dead.

I've been completely inactive when it comes to yard work for about 3 weeks now. While we had lovely weather in June, July and August have been oppressively hot and humid. This was the first day I've been able to do anything, and since this decent weather is supposed to hold at least til the end of the week, my goal is to do something in the yard each and every day. I have 3 ironweed plants and a gooseberry that have been in pots all summer and really need to go in the ground, but clearing areas where they go is a ton of work. Must be done!

But going after the tree of heaven is a top priority.

Here's an update on my cash flow situation since my last post: my checking balance has shrunk to $3583, and that needs to last me for another 4.5 weeks. I will get an infusion of $932 Sept 2 from my annuity. I should be able to stretch it out until the CD matures.

I've been picking tons of cucumbers and tomatoes. I'm only growing cherry tomatoes and a yellow grape hybrid. I've gotten a decent amount of yellow squash, and my stringbeans should be developing beans any day now, since they're flowering. I've given extra cucumbers to my father, who likes to pickle them, and my friend/neighbor R.

My knotweed group is meeting on site this week at a popular walking trail in town where a smallish patch of knotweed has been sighted. We will make it a demonstration plot, mowing one side and then cutting and then treating the other side with herbicide, with instructional signage designed to show residents walking by that mowing alone won't be effective.

Still going to the gym 4x a week.

This, in a nutshell, has been my summer.

Since coming to the realization that I need to move, I've been looking around here with different eyes. With thoughts about staging the house, eventually, and still working to give things away for less clutter. Today I posted a rather beat up old rattan chair that I acquired from Buy Nothing, but no one wants it so to the dump it goes. I have a sentimental thing for rattan, a hangover from growing up with my grandparents' complete patio furniture set, all rattan.

I think it was actually something Dido said that made me realize I was just fooling myself by saying I was going to "age in place" here. The yardwork, or my inability to care for the property the way I think it should be, would likely always be a source of stress for me. I want to do other things with my life. I was telling my father of my decision and he surprised me by telling me his opinion, which was that I shouldn't move. He hardly ever insinuates his opinion about anything, so for him to say something was unusual. Basically, he said you have everything you want in your house now, and the yard is only a source of stress because I allow it to be so, and that most people would not be so focused on invasive plants, etc.

That doesn't really change how I feel about things though.

These comments were made on the same day that he confessed his regret about selling his beautiful home on the Jersey shore, which he'd made so many improvements to, to live in a small studio apartment on my sister's property. He decided to try renting out the home for a while (which I would never have done, given the distance between that house and where he moved to), and unfortunately, he failed to do a background check on the woman who someone at his favorite diner said was looking for a place. She was late with the rent from the get go, often not paying the full amount. He had to start eviction proceedings and she stole things he left in the house. (Carelessness on his part, I have to say.) Because she had no assets, his attorney told him it wouldn't be worth pursuing in court. An all-round unpleasant experience that I got to experience as well since I had to drive my father down to NJ a few times to meet his attorney. Sigh. Well, that's all in the past now.

Posted in

Uncategorized

|

1 Comments »

August 6th, 2024 at 10:50 pm

I brought my father to physical therapy this morning, then took him out to lunch afterwards. I drove back home around 2 pm. When I walked in the front door, my cat immediately began meowing to be fed, and when I walked into the kitchen, there was a funny noise coming from the basement that sounded a little different.

Wondering if either my central air or my new heat pump hot water heater was malfunctioning, I went into the basement to find about half the basement floor covered in water and then, shockingly, I saw that the cause of the sound was a burst pipe where water was gushing out.

I was able to stop it by turning off the water for the whole house. There was plenty of water on the floor, but judging from the amount of water, it seemed that it had only been gushing out for 5 or 10 minutes. That's why I think if I had arrived even 20 minutes later, I would have had a REAL mess on my hands. I can't imagine what I would have found if I had been away for a much longer time period. This is the kind of thing you just can't prepare for; it just randomly happens.

I started calling plumbers but all I was getting was answering machines. Since I had no water in the house now, I didn't want to wait around for someone to call me back, so I kept calling til I found one right up the road that I have never used. He said he could come over in a half-hour.

I found the cap that had burst off the main water line on the basement floor and showed him. He told me it was quite old because it was made of iron, and nowadays they are made of brass, and said that it was the wrong type to have been used on my water line. It was an easy fix for him. Since he was there, I showed him some copper piping that was pretty badly corroded and he said since the burst pipe didn't take up the full hour, he could fix the copper corroded pipes for just an additional $38 (materials), so I had him take care of that too. A good thing to do since I'm planning on selling the house now. All told, I felt kind of fortunate to have only had to shell out $213 for this unexpected emergency.

While he was here, the other plumbers I had called started calling back, and the wife of one of them texted to tell me that her husband and assistant were on their way, but I was able to tell her I already had someone here. At least now I know these plumbers do respond fairly quickly to emergency situations.

In my town, if you ask someone whose a good plumber to call, 85% of the time you get 1 of 2 plumbers who are mentioned again and again. It's like they have a lock on the town. There are plenty of other plumbers, but they are recommended less. As a result, these top 2 plumbers charge a premium, it seems. I have used them both; they were both competent, but I had issues with both of them, aside from price.

So I was happy with the plumber who came here today and will call him first should I have a need moving forward.